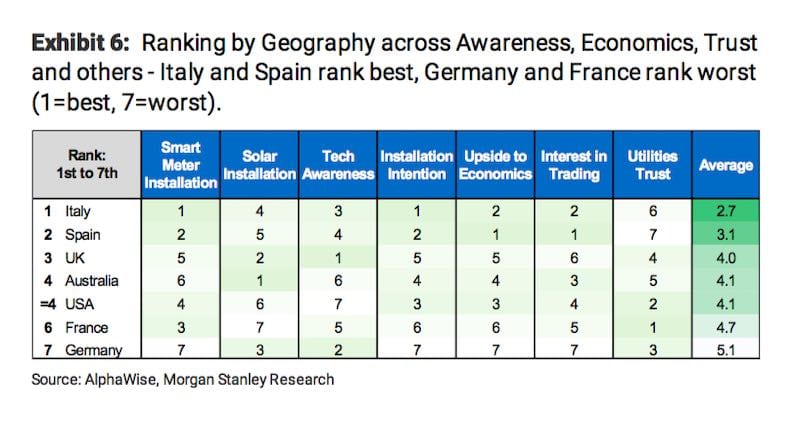

Australia is at the forefront of a massive shift in the business models of traditional energy utilities, but countries like Italy and Spain may take the lead in the transition because consumers in those countries are more “tech aware”, a new study suggests.

The report by analysts from Morgan Stanley – “Consumer revolution: Shining a light on how the Utilities world is changing” – says the consumer transition to a new energy world is gaining momentum, driven by the uptake of rooftop solar, and the growing penetration of smart meters, electric vehicles, battery storage, and the growth of stored data and “consumer smarts.”

This, the analysts say, will have a snow-ball effect, driven by that availability of more data, and the desire from younger generations for more new technology.

The survey finds that, globally, one in three consumers want to generate their own power – most likely through rooftop solar – in the next five years and are interested in trading it. And then storing it, and then using it for their transport.

“There is a snowball effect – once one energy technology is installed, it increases the likelihood of consumers wanting an additional technology,” the analysts say.

“Younger consumers show higher awareness and interest, so as time passes, and costs come down even further, the transition should accelerate further. The consumer is a winner, for utilities it is less clear.”

Australia finds itself at the forefront of this transition on sheer numbers, with 30 per cent of consumers already installing rooftop solar – now totalling 9GW, with forecasts of it reaching nearly 30GW by 2030.

However, while Australia is seen as a “global testing ground”, the lack of awareness of new technology (see the graph above, maybe we have the Murdoch media to thank for that!) and the relatively slow rollout of smart meters may limit the scope and pace of that transition.

On the other hand, utilities in Australia are not well trusted by consumers, and have done comparatively little to prepare themselves for the transition.

The prediction for massive disruption of the electricity industry has been around for a while. In Australia, the enormous growth of rooftop solar has eaten into traditional revenue streams, but the impact has been largely contained, thanks to the regulatory protection that the market rules provide the incumbents.

But that is about to change. The Australian Energy Market Operator understands that without rule changes and a new market designs, the shift to distributed generation is going to be incredibly difficult to manage, and will make it harder for it to ensure grid stability and reliability.

So it is setting about changing those rules, and urging the institutions responsible to act with haste. The utilities are hanging in there, hoping to shape the reforms in the image of what they may see their future model being, but the sheer scale of disruption could be impossible to contain.

And while most discussion has focused on the shift in primary energy technologies, from coal and gas to wind and solar, and from centralised “base-load” generation to a more decentralised “dispatchable” system based around the mix of renewables and storage, the Morgan Stanley report focuses on a new element – data, smart meters, and changing demographics.

This graph above illustrates the extent to which the model is being challenged. It’s not only about the massive cost reductions in solar (99.5 per cent since 1977) and lithium ion battery packs (85 per cent since 2010), and the need to cut emissions, it is also the amount of data created over the last two years, and the increase in IoT devices.

This graph above illustrates the extent to which the model is being challenged. It’s not only about the massive cost reductions in solar (99.5 per cent since 1977) and lithium ion battery packs (85 per cent since 2010), and the need to cut emissions, it is also the amount of data created over the last two years, and the increase in IoT devices.

Just look at those numbers. Some 90 per cent of all data has been created in the last two years, with more than 2.5GB of data created each day, and more than 31 billion extra IoT devices to be connected in the next two years.

“The world is changing quickly, and utilities will need to follow suit,” the Morgan Stanley analysts say.

“The new world, with consumers taking greater control, could see risks to traditional energy supply profit pools (which are material across the globe).

“Selling new services, or being part of this journey with consumers, could help defend these pools or enable new revenue opportunities, but we have since little evidence of the latter to date. We see greater risk in Europe and Australia, than in the US.”

“Selling new services, or being part of this journey with consumers, could help defend these pools or enable new revenue opportunities, but we have since little evidence of the latter to date. We see greater risk in Europe and Australia, than in the US.”

In Australia, Morgan Stanley is cautious about the ability of incumbent utilities to negotiate these structural headwinds. It notes that Origin, less dependent on a large fleet of coal generators than AGL, is less exposed to changes in the wholesale market, and it is adopting a “fast following strategy for power-telco convergence, providing a white- labelled broadband solution.”

AGL, on the other hand, has closed its new energy division and exited residential solar, “and is now pursuing, in our view, telco convergence strategies.” It recently looked at a multi-billion dollar purchase of Vocus, but backed off.

“A key challenge for all incumbent utilities in Australia is low consumer trust, which is, in part, a function of rapidly rising retail prices (real prices have doubled over the last ten years),” the analysts note.

“Put simply, while AGL and ORG can benefit from high prices, we think that, absent company counter-measures, the businesses are likely to sell fewer electrons and molecules (demand loss to competitors and substitutes) to fewer customers (market share attrition to Tier 2 competitors) out of growing cost bases (aging plants requiring replacement),” the analysts say.

So what does that mean for the future? Well, as most utility executives and analysts will tell you: Who knows?

So much depends not just on consumer preference, but the rapid change in technologies, the ability of regulators and rule-makers to keep up, how they adapt, and what room utility executives have to plan for the long term, and prepare for major disruption, while trying to maintain their short term profits.

There’s no doubt that Australia’s utilities have proven excellent at the short-term profit making. Just how equipped they are to deal with the futured is still a big question, and one they may not be able to answer until the new market rules – supposedly designed to be in place by 2025 – are unveiled.

Source: RenewEconomy