Bitcoin: The Calm Before Another Storm

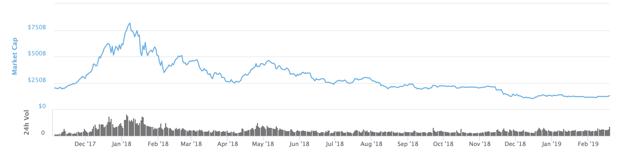

Bitcoin (BTC-USD) has been in another period of incredible calm lately as the digital asset’s price has remained in an atypically narrow trading range of about $3,200 – $4,200 for nearly three months now.

Bitcoin 6-Months

Source: Bitcoincharts.com

These quiet periods always are concerning, as the last time Bitcoin was “calm,” it preluded a crash of nearly 50%.

So, is history about to repeat itself? Will Bitcoin fall through the $3,200 level and crater to new multi-year lows? Or is the digital asset destined to recover? Also, is Bitcoin likely to go much higher going forward and longer term?

I believe that this time the calm before the storm will lead to a rebound in prices. Moreover, numerous factors suggest the current bear market is likely going through a prolonged bottoming process right now.

Ultimately, the start of a new bull run appears inevitable. Furthermore, improved adoption amongst users and an increased presence by institutional investors should substantially boost sentiment and drive demand going forward. Therefore, Bitcoin is likely very close to a bottom here, and the digital asset probably has substantial upside potential going forward.

Did Bitcoin Just Bottom?

It’s been a tough time for Bitcoin, as the digital asset had declined by about 84% from its peak in 2018. Even now, Bitcoin continues to drift around the lows, and it’s not just Bitcoin.

The whole cryptocurrency complex had a bloodbath of a year in 2018, and 2019 hasn’t brought much improvement. Litecoin (LTC-USD), the No. 5 coin (by market cap), is down by about 89% from its top, Bitcoin Cash (BCH-USD), the No. 4 coin is down by about 95% from its high, Dash (DASH-USD), another prominent top 20 coin, is down by nearly 95% from its top, Zcash (ZEC-USD) the No. 20 coin is down by 94% from its high, etc.

Moreover, 90%-plus declines are not unique to the coins I’ve just mentioned. It appears that the entire cryptocurrency market got flushed out, as 90%-plus declines have been a common phenomenon in this extraordinary cryptocurrency crash.

In fact, just showing percentage declines does not properly illustrate the immense carnage the cryptocurrency complex went through last year. Illustrating the declines in dollar terms and market cap value deterioration provides a much more comprehensive image.

- Bitcoin: price decline $19,500 – $3,600, market cap decline $327 billion – $63 billion, total loss of market value $264 billion.

- Bitcoin Cash: price decline $4,000 – $122, market cap decline $69 billion – $2.1 billion, total loss of market value $66.9 billion.

- Litecoin: price decline $366 – $42, market cap decline $19.9 billion – $1.9 billion, total loss of market value $18 billion.

- Dash: price decline $1,500 – $80, market cap decline $11.6 billion – $700 million, total loss of market value $10.9 billion.

- Zcash: price decline $876 – $53, market cap decline $2.6 billion – $313 million, total loss of market value $2.3 billion.

- Overall Cryptocurrency Complex: market cap decline $833 billion – $120 billion, total loss of market value $713 billion.

Cryptocurrency Complex Market Cap

Source: Coinmarketcap.com

An incredible $713 billion in market value (86%) has been wiped out in this grizzly bear market crash. Sentiment has been rocked to a degree rarely seen in any market. In fact, sentiment has degraded to such an extent that a popular theory among skeptics these days is that many digital currencies, even Bitcoin, could essentially become worthless, or decline close to zero.

However, I’m not surprised, and this is the exact kind of pessimism and negativity I expect to see at or near a bottom in any market.

Bitcoin has been around for roughly 10 years now, and in that time, Bitcoin has continuously gained more popularity, recognition, and wider adoption. In fact, there have been several waves that took Bitcoin from something extremely obscure and essentially unknown to a worldwide phenomenon.

These waves can be observed in Bitcoin’s long-term chart pattern. The first notable wave came in early 2012, then a second came in 2013, and then the latest wave started in 2016.

Now we are looking for wave number 4 to arrive that should take prices higher once again. Although it’s difficult to predict exactly when the fourth wave will begin, it will likely start sometime this year, and judging by Bitcoin’s price action history, it could bring the digital asset up to new all-time highs, possibly to the $50,000 – $100,000 region.

Why the $50K – $100K region?

If we take another look at Bitcoin’s long-term chart, we can see that in prior cycles Bitcoin’s price moved up by roughly 2,000% – 10,000% from trough to peak. So, if we implement the lower end range of 2,000% and combine it with the recent low of $3,200, we arrive at a possible lower-end peak of around $67,200 for the next bull cycle.

Bitcoin Historic Chart

However, something is needed for Bitcoin to go substantially higher once again, and that’s an improvement in sentiment and a perceptible path toward mass adoption.

Did You Think Mass Adoption Would Occur Overnight?

It’s amazing that many market participants have given up on Bitcoin after 2018. You’d think many investors would be rushing to buy at these deeply discounted levels, yet, the opposite appears to be true.

After all, many technology companies that declined by 80% or 90% following the 2000 tech bubble went on to become some of the most valuable and powerful companies in the world (think Amazon (AMZN)), and there’s no reason to believe that Bitcoin won’t return in a big way either.

We are still in the very early stages of the digital currency revolution, and investors should take a much longer-term view before concluding that Bitcoin is dead or is an unworthy long-term investment.

Furthermore, there have been several prior waves of extreme price appreciation which were then followed by prolonged bear markets. Declines such as the latest 84% drop are nothing new in the world of Bitcoin as the digital asset has gone through several such 80%-90% declines in the past.

Ultimately, Bitcoin is being adopted by more people every day, but the path to mass adoption will likely be a very lengthy multiyear, or even multi-decade process.

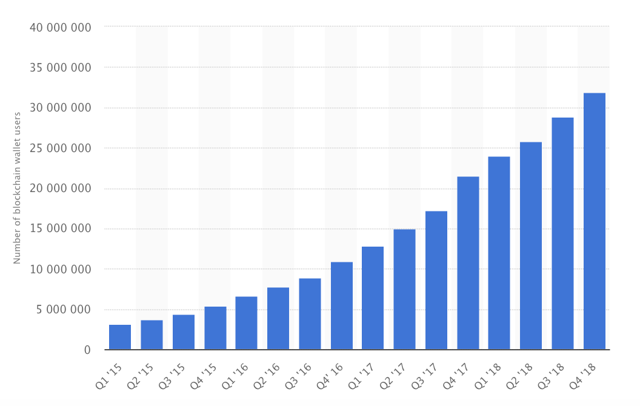

Nevertheless, it’s estimated that roughly 3 million people actively use Bitcoin and other cryptocurrencies. This is out of over 30 million blockchain wallets, which implies that most Bitcoin owners don’t transact in the digital currency yet.

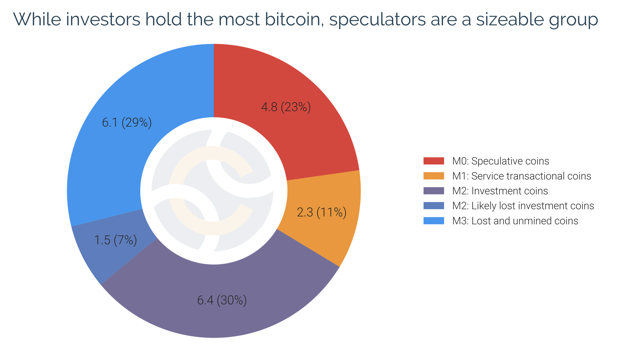

Another study uncovered that only about 2.3 million or 11% of all Bitcoins are used for transactional purposes. 23% are estimated to be speculative coins (owned for trade), about 30% are owned by long-term (buy and hold) investors, and about 36% of coins are either lost or have not been mined yet.

Source: Chainalysis.com

There are about 7.7 billion people on this earth, an estimated 3.2 billion use the Internet, yet only about 3 million actively use Bitcoin, and based on statistics fewer than 30 million own any Bitcoin at all.

In fact, if we look at the cryptocurrency picture objectively, there are about 33 million blockchain accounts right now. Now, it’s impossible to say how many, but certainly many users have multiple accounts, and numerous accounts have been abandoned, or access to them has been lost.

Blockchain Wallets (Accounts)

Source: Statista.com

Possibly the best way to estimate the number of Bitcoin owners around the world is to exclude the roughly 4 million lost, and likely lost Bitcoins, which would drop the current supply of coins to only 13.5 million.

The study showed us that only about 2.3 million or 17% of these coins are being used actively to service transactions. Therefore, we can assume that the estimated 3 million active bitcoin users are the ones largely responsible for these transactions, and likely amount to about 17% of total Bitcoin owners. Therefore, if 3 million active Bitcoin users represent about 17% of all Bitcoin owners, then the total number of Bitcoin owners around the world is only around 17.6 million.

(This suggests that nearly 50% of all blockchain wallets (accounts) are either “lost” due to lost keys, abandoned/unused, or can be attributed to multiple account holders).

This is a Big Market, and Bitcoin is Just Getting Started

17.6 million Bitcoin owners in an applicable market of 3.2 billion internet users implies only about 0.55% or about half of just 1% of the applicable users own Bitcoin, and even fewer, only about 0.01% or one tenth of 1% use Bitcoin regularly. This also suggests that only about one in every 200 people owns Bitcoin, and only about one in every 1,000 people uses Bitcoin regularly.

On the flipside, this illustrates rather well just how much market share potential Bitcoin has. With only about 0.5% of the applicable market participants owning Bitcoin today, around 99.5% of the market is unpenetrated. Furthermore, when it comes to transacting in Bitcoin, about 99.9% of the market remains untapped.

Hence, just a modest increase of market share to roughly 1, 2, or 5% ownership could have dramatic implications for sentiment, demand, and ultimately Bitcoin’s price. At 1% share about 32 million people worldwide would own Bitcoin, at 2%, roughly 64 million would own it, and at 5% penetration about 160 million people around the globe would own Bitcoin (mostly fractions of Bitcoins). It’s important to keep in mind that even at 5% penetration, over 3 billion global inhabitants with Internet access would still not be exposed to Bitcoin ownership.

Why Would More People Want to Use Bitcoin?

There are numerous reasons why more people will likely start to adopt cryptocurrencies over time. The simplest way to explain it in my view is to say that Bitcoin and digital currencies in general are far more compatible with technolog, and the Internet than the current fiat system.

Source: CCN.com

Furthermore, decentralized cryptocurrencies like Bitcoin offer a more attractive payment system as it inherently excludes parasitic third parties that monitor, limit, and tax every single transaction.

Additionally, Bitcoin, and other prominent coins are immune to inflation, as there’s only a set number of coins that can ever exist in circulation, which makes digital assets structurally more sound than their fiat counterparts.

Therefore, at their core, Bitcoin and other digital coins supersede fiats in both underlying asset (currency) qualities, and the payment system (decentralized blockchain) side of the equation as well.

A simple example…

Bitcoin can be sent from a wallet (blockchain account) regardless of where the person is physically on the globe to any other wallet on earth. The transaction occurs within minutes, the cost is minimal (roughly $3.60/0.001 of one Bitcoin), and the person can send any amount they desire, $10,000, $100,000, etc.

This task can be accomplished with ease, as there’s no predatory, parasitic third party monitoring, limiting and taxing this transaction. However, when a similar transaction must be done using the current banking system, everything becomes much more difficult and far more complicated. Banking channels need to be set up ahead of time in many cases, the cost is much higher, and the transaction could take days to confirm.

Then there’s the transaction sum. If it’s higher than a certain figure the government gets alerted, and you may have to answer questions about what you are doing with your own money, which is a big annoyance at the very least, and may even be considered an absurdity.

The bottom line is that a payment system without a redundant third party is much cleaner and is much more efficient in conducting transactions. Moreover, there’s a cost benefit to consumers which makes Bitcoin and digital currencies in general very desirable transactional vehicles that are likely to experience increasingly higher rates of adoption over time.

Companies Already Accepting Bitcoin

There are numerous global enterprises that already accept Bitcoin for various products and services. Among the major companies are general merchandisers like Overstock.com (OSTK), Fancy.com, and BitPlaza. Microsoft (MSFT) also accepts Bitcoin now, so does Shopify (SHOP) and many others.

If you want to travel, you can go to Expedia.com, CheapAIr.com, or visit Bitcoin.Travel to pay for your traveling needs in Bitcoin. You want premium travel? Premium Jet and PrivateFly both accept Bitcoin now.

Food you want? You can visit PizzaForCoins.com or a host of other services to pay for your food not just in Bitcoin, but using a variety of prominent digital coins. Entertainment? DISH Network has been accepting Bitcoin since 2014.

If you want a car, you can pay for your Tesla (TSLA) in Bitcoin, and yes, you can even book a flight to space at Virgin Galactic using Bitcoin.

100s of companies now accept Bitcoin readily, and this is likely only the beginning of a lasting trend.

This trend is very likely to continue as Bitcoin is likely to garner more popularity and greater acceptance in future cycles. Also, even if many major corporations don’t convert to accepting Bitcoin in the immediate future, more Bitcoin related services that handle conversations and facilitate transactions should continue to help the overall assimilation process. Furthermore, businesses that don’t conform to accepting Bitcoin in the future are subject to miss out on lucrative revenues and are thus likely to adapt in time regardless.

Institutions are Coming

Simply because we have not seen an enormous influx of institutional money into the cryptocurrency complex yet does not mean it won’t come eventually, and possibly soon even.

Most institutions completely missed out on Bitcoin’s first major wave in 2017. Digital assets are unique to the financial industry, as they were mostly created independent of Wall Street, Silicon Valley, and other traditional asset creators.

However, this does not mean intuitions will not want to take part when the next wave begins. Prior waves to 2017 were simply too small for most major players on Wall Street to take notice. But as the cryptocurrency complex reached nearly $1 trillion in market value last year, big institutions did take notice, and they are likely watching very closely for signs of a bottom.

Bitcoin has already been legitimized in the financial world by the introduction of Bitcoin futures contracts, which formally made Bitcoin an official commodity. The next step is introducing Bitcoin ETFs which will create an enormous easily accessible market for both institutional and retail investors.

There are continuous petitions for Bitcoin ETF approvals, and many are brought forth by some of the largest players in the business like VanEck and others. It may happen this year, or it may happen next year, but it’s extremely likely that official Bitcoin ETFs start getting approved eventually.

Goldman Sachs (GS) is working on a Bitcoin derivative product for clients. Fidelity launched an institutional platform for Bitcoin. Blackrock (BLK) and others are also “looking into bitcoin.”

Investment banks are likely to play an increasingly crucial role in the next bull market cycle. In addition to the introduction of ETFs, institutional players are likely to increase liquidity, fund projects, and should greatly expedite the adoption process of digital currencies as mainstream investment vehicles.

In the End, It’s All About Sentiment

Bitcoin, like any investment vehicle, relies on sentiment. However, Bitcoin, even more so than most other assets as there are no earnings or cash flow, and the entire asset class is a relatively new phenomenon.

That’s why Bitcoin’s price is so incredibly volatile, as sentiment rules, driving demand, and thus price, one way or the other. However, one thing that differentiates Bitcoin from just about all other assets is that supply is capped. Therefore, if demand increases, the price has nowhere to go but up.

Back in December 2017, Bitcoin was approaching $20,000, everyone was talking about it, sentiment was sky high, and Bitcoin was prophesized to take over the word in one way or another.

However, now that Bitcoin crashed by more than 80%, is trading around $3,600, sentiment is horrid. Do we need Bitcoin? What’s it good for? Is it going to $2,500, $1,000, zero? These are some of the questions on people’s minds now.

The sentiment image has flipped from how high will Bitcoin rise at the highs to how low can it go at the lows. At nearly $20K was the time to stay away, and now is very likely the time to buy. It is like Warren Buffett says, “be fearful, and sell when most are greedy, and be greedy and buy when most are fearful.”

Even though some claim because Warren Buffett made this quote popular, it should not be applied to Bitcoin, but I disagree. I think it applies perfectly to Bitcoin, especially right now.

The Bottom Line: Bitcoin Likely Going Much Higher

Bitcoin and other digital assets have been crushed since peaking in late 2017 and in early 2018. We’re talking epic meltdown proportions, filled with 80%-90%, and in many cases 90%-plus declines.

Bitcoin is currently going through another period of calm, and while prior quiet periods have led to further declines, this time it will likely lead to a bottoming process instead.

Bitcoin had declined by about 84% from its highs, a decline consistent with prior bear market bottoms. Furthermore, it appears that the recent declines could be part of a relatively normal life cycle for Bitcoin as the digital asset has gone through several similar waves/cycles in the past.

Bitcoin and digital assets in general represent a superior form of currency and payment system to the current fiat order in many ways, and are likely to experience increased demand in the future. Bitcoin has continuously garnered higher levels of popularity and adoption in prior waves, and this trend is likely to continue throughout future cycles. Furthermore, based on Bitcoin’s price history analysis, the digital asset could hit a price point of $50,000 – $100,000 in its next bull market cycle.

Bitcoin’s market penetration remains incredibly low, at just 0.55% ownership penetration rate, and 0.01% use penetration of the applicable market. In other words, 99.45% of the store of value market remains untapped for Bitcoin, and roughly 99.9% of the transactional market remains untapped (population with access to internet, not volume).

Now is likely an excellent time to buy Bitcoin and build exposure to other prominent coins. I have added to positions several times throughout the recent lows and I increased my position by another 33% in recent days, as I feel prices are likely going to recover, and go substantially higher in future months, years, and decades.

Risks to Bitcoin

Detrimental Government Regulation

Possibly, the No. 1 long-term threat Bitcoin faces is detrimental government regulation or an all-out Bitcoin ban. If major Bitcoin-friendly governments like the U.S., E.U., Japan, South Korea and others follow the footsteps of China and essentially make Bitcoin use and trading illegal, it could have catastrophic consequences for Bitcoin’s price. Demand would likely plummet, and when demand for a commodity decreases, so does its price. This seems unlikely due to the progressive steps taken in the U.S., E.U. and other areas concerning Bitcoin, but the threat does exist.

Continued Functionality Issues

Another risk factor is the concern that Bitcoin may never become a widely-used transactional currency due to its issues with speed and scale. Yes, the Lightning Network promises to solve many of the issues associated with speed, cost and scale, but there’s no guarantee that the LN will become widely adopted, even over time.

Therefore, there’s the risk that newer and more efficient digital currencies like Litecoin, Bitcoin Cash and others may make Bitcoin somewhat obsolete as an actual medium of exchange for the masses.

Continued Security Breaches and Fraudulent Activity

Continued security breaches in the Bitcoin world concerning exchanges and individual wallets is a constant concern. If significant breaches continue, investors and users may start to lose confidence in the system and demand could decrease as well.

Likewise, there are fraud cases. In an industry that’s still loosely regulated, substantial fraudulent activity is a persistent risk factor. Just like with security breaches, when people get ripped off, it reflects poorly on the entire industry and demand along with prices can suffer.

One Million and One Cryptocurrencies

Another concern is the seemingly endless supply of new cryptocurrencies. There are now more than 2,000 different cryptocurrencies listed on CoinMarketcap.com. The risk is that the market may become oversaturated with digital assets which could lead to a perpetual decline and devaluation of many digital assets, including Bitcoin.

Loss of Interest Among the Masses

There’s always the simple risk of loss of interest amongst the masses. There’s a chance that Bitcoin will forever remain a niche phenomenon, a novelty, as JPMorgan’s Jamie Dimon put it. In this case, Bitcoin may not experience substantial demand, and the price would very likely cascade lower over time.

Bitcoin is Not for Everyone

The bottom line is that Bitcoin is not for everyone. I view it as an investment for people with a relatively high risk tolerance, and even then, maybe only 5%-10% of a portfolio’s holdings should be allocated to digital assets.

Bitcoin is still a relatively new phenomenon, and no one truly knows exactly how it’s going to play out over the long term. The truth is that due to the numerous uncertainties, 10 years from now one Bitcoin could be worth $1 million, or it could be worth close to zero.

Disclaimer: This article expresses solely my opinions, is produced for informational purposes only and is not a recommendation to buy or sell any securities. Investing comes with risk to loss of principal. Please consider consulting a professional before putting any capital at risk.

Want more? Want full articles that include technical analysis, trade triggers, trading strategies, portfolio insight, option ideas, price targets, and much more? To learn how to best position yourself for a rally in Bitcoin please consider joining Albright Investment Group!

- Subscribe now and obtain the best of both worlds, deep value insight, coupled with top-performing growth strategies.

- Receive access to our top-performing portfolio that outpaced the S&P 500 by roughly 20% in 2018.

- Take Advantage of the limited time 2-week free trial offer now and receive 20% off your introductory subscription pricing. Click hereto learn more!

Disclosure: I am/we are long BTC-USD, BCH-USD, LTC-USD, DASH-USD, ZEC-USD. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Source: “bitcoin” – Google News