A critical re-test of December lows could place severe pressure on the US stock market. With the Dow already reeling from five straight days of losses, BMO’s chief analyst Russ Visch warns things could get “ugly” for the index and its peers, the S&P 500 and Nasdaq.

BMO: S&P 500 Crosses Critical Selling Trigger

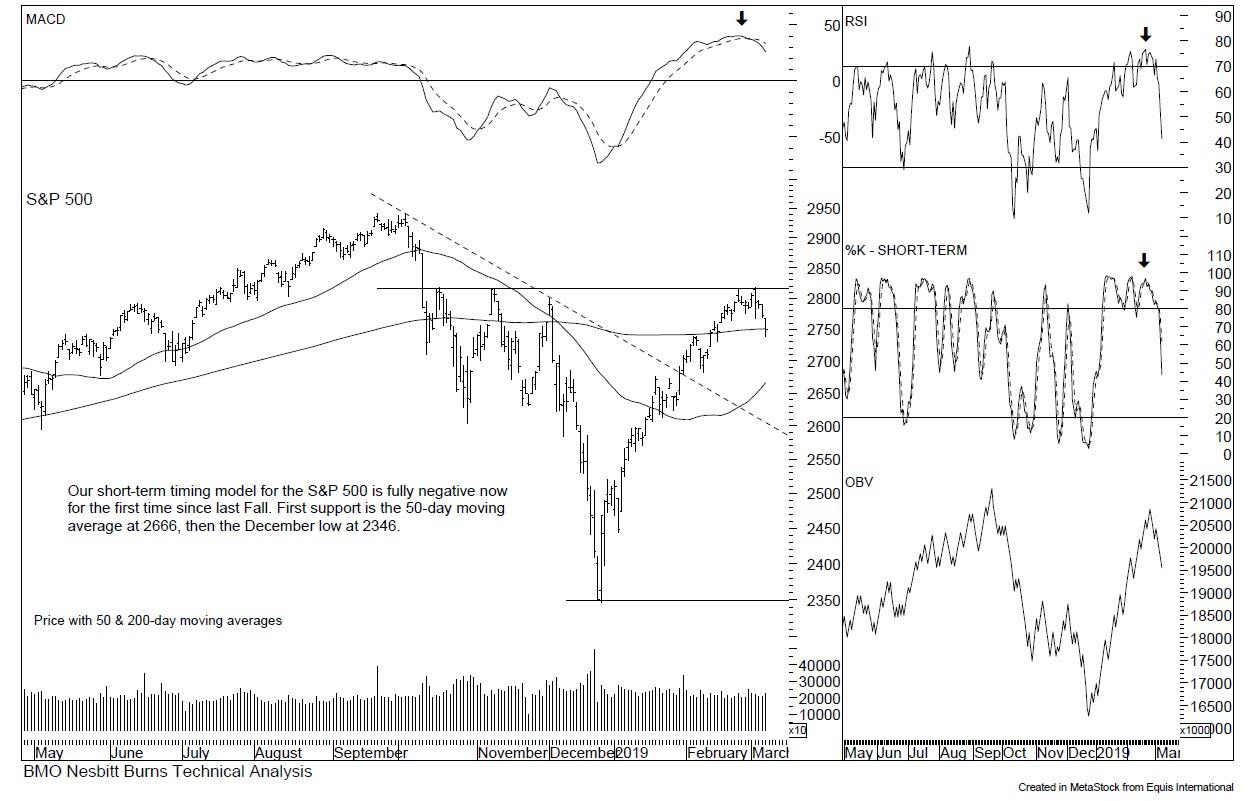

ZeroHedge outlined the S&P 500’s drop below 2,750 as a “critical selling trigger,” warning that commodity traders have now started to sell.

Adding to the bearish outlook, the Bank of Montreal’s Russ Visch proclaims that the “goldilocks” rally has ended – “goldilocks” referring in economics to a period where inflation is neither too high or too low to trigger inflation.

BMO warns that things could get “ugly” for the S&P 500 and Dow before they get better. | Source: BMO/ZeroHedge

Visch believes the S&P 500 failing to hold above 2,800 signals a “rally re-test” and that a potential US stock market bottoming is underway. The Nasdaq also closed yesterday below its 200-day moving average for the first time in almost four weeks.

Next Friday sees a scenario where all four types of options and futures contracts expire on the same day, leading Visch to say the markets “could get ugly” as traders and investors reposition their holdings.

US Stock Market Sees Worst Week of 2019: Dow Jones Posts 5 Straight Losses

At the close of this week’s trading, the Dow Jones Industrial Average recorded five days of straight losses. Dismal jobs data has stirred cries of recession once again, with the US economy seeing its slowest pace of employer hires since September 2017.

Alec Young, managing director of global market research at FTSE Russell told CNBC:

“February’s anemic 20,000 new jobs will inevitably exacerbate widespread fears of slowing economic growth, making it harder to be optimistic about corporate earnings.”

The S&P 500 now sits at 2,743 following Friday’s 0.2% decline, more than 50 points below the 2,800 mark that has already swatted down multiple stock market recovery attempts.

The Dow Jones Industrial Average (Red), Nasdaq (Blue), and S&P 500 (Yellow) all plunged this week as the US stock market suffered a major setback. | Source: Yahoo Finance

China’s sudden equities implosion added to US stock market pressures on Friday with local indices such as the Shanghai Composite suffering their most significant losses this year. This after new export data heralded a potential “trade recession” in China. Add in a bevy of reports wiping Trump’s positive trade deal rhetoric off the table, and the Dow’s parabolic recovery suddenly seems on thin ice.

With all major indexes in decline, it’s now officially the worst week of 2019 for America’s stock market. The Nasdaq has broken a 10-week winning streak, and for the Dow Jones, it’s the second consecutive weekly fall after nine straight weeks of gains.

Other Analysts Search for Silver Lining in Dow Pullback

Not everyone has succumbed to doom-and-gloom predictions, however.

Peter Perkins of MRB Partners says a “pullback” was necessary but that “fundamental conditions are positive.”

“The global growth outlook remains mixed, but there are signs that economic growth momentum in China and the euro area is bottoming, while the U.S. economy continues to chug along at a moderately above-potential pace.”

Similarly, Goldman Sachs said earlier this week that any further stock market gains would need to be “fundamentally-driven,” though its expectations were for a “stronger than expected recovery.”

Nevertheless, with a trade deal now unlikely until as late as April, the US stock market seems to have run out of gas. Analysts like Visch expect next week to be a crucial one for the Dow.

Source: Crypto New Media