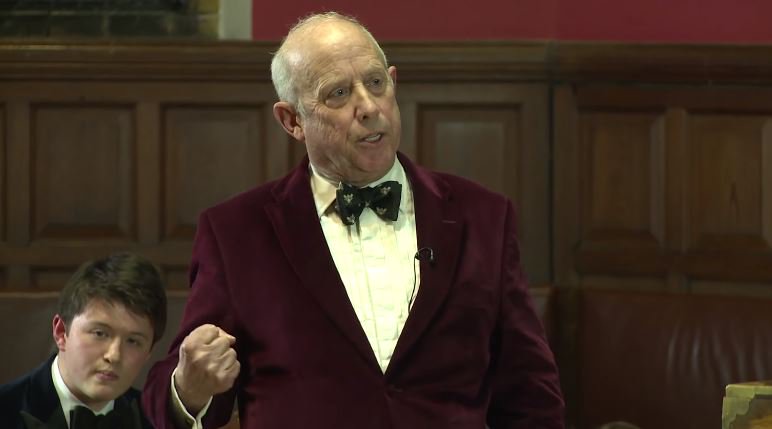

At a European Parliament meeting in 2013, British politician Godfrey William Bloom said that all major banks are broke and criticized the ability of banks to lend money they do not have, which is not possible with decentralized currencies like crypto.

At the time, Bloom stated that the ability of central banks to print and distribute artificially created money by way of quantitative easing, or printing of new money, has led to a creation of a heavily manipulated financial system.

“It is my opinion that you do not really understand the concept of banking. All the banks are broke. Bank Santander, Deutsche Bank, Royal Bank of Scotland, they’re all broke. Why are they broke? It isn’t an act of god. They’re broke because we have a system called fractional reserve banking. Which means, the banks lend money they don’t actually have. It’s a criminal scandal, and it’s been going on for too long.”

Alternatives are Available

Just a little more than five years ago, Bitcoin, the most dominant cryptocurrency in the global market, was valued at less than $100. At the time, due to the lack of usage of Bitcoin and cryptocurrencies in general, there were no viable alternatives to cash or fiat money that businesses and individuals could rely on.

Politicians including Godfrey Bloom expressed serious concerns towards quantitative easing, a system of printing new cash, as it provided central banks significant leverage over the economy and the global financial system.

He emphasized that both fractional reserve banking and quantitative easing are criminal operations which if done by any regular business or individual is considered unlawful.

“To add to that problem, you have moral hazard. A very significant moral hazard from the political sphere. Most of the problems start in politics and central banks, which are part of the same political system. We have counterfeiting, sometimes called quantitative easing, but counterfeiting by any other name, the artificial printing of money, which if any regular person did, they would be in prison for a very long time. Yet, governments do it all the time. Central banks repress the amount of interest rates, so we do not have the real cost of money.”

As seen in the isolation of Iran from the global banking system called SWIFT by the US, when central banks have absolute control over the world’s financial network, then it becomes possible for several dominant economies to censor payments.

Professor Steve Keen, an economist at Kingston University, said, “the USA is big enough to bully what should be an impartial means for monetary transactions between countries. This should not be possible.”

Through the form of crypto, an alternative system to the global banking system and central banks has become available to individuals, organizations, and governments, and several countries including Iran have started to explore ways to utilize decentralized systems to process cross-border transactions.

Will the Fiat Bubble Burst?

Already, major banks like Deutsche Bank have begun to struggle with their finances, and some countries have opted to test cryptocurrencies as an alternative to central bank-controlled fiat currencies.

In the long-term, if Europe and other regions pursue with their pending plans to create several financial networks independent of the US, the transition could naturally lead to consensus currencies like crypto.

Featured Image from OxfordUnion/YouTube

Source: CCN