Sandbag, based in Brussels and London, published its latest analysis of European coal generation in a new report at the end of July entitled Europe’s Great Coal Collapse of 2019 and, as the title suggests, the news was not good for the European coal industry.

Coal generation fell by 50 terrawatt hours, offset by a 30TWh increase in wind and solar generation and an increase of 30TWh in natural gas generation.

“2019 may mark the beginning of the end for coal power in Europe,” said Dave Jones, an Electricity Analyst at Sandbag. “The biggest falls are by those countries encouraging wind and solar and planning for a coal phase-out.

“Now that carbon pricing is finally working with price approaching €30 per tonne, the economics have already shifted not only from coal to gas generation, but also from coal to clean generation.

And now the economics have changed, policymakers will now find it is much easier to support wind and solar, and to plan for a full transition from coal to clean.

“Every country could achieve a 2030 coal phaseout, if they put their mind to it.”

All Western European countries saw significant declines in coal generation – led by Germany (in absolute terms), which saw coal generation fall by 22%, with both hard coal and lignite falling substantially.

Over two-thirds of the fall in lignite coal generation came from RWE’s Neurath and Niederaussem plants which are supplied by RWE’s troubled Hambach and Garzweiler mines, while generation fell at 32 out of Germany’s 35 lignite units which are no longer generating electricity 24/7.

Unfortunately, despite this massive collapse, Germany was still responsible for 35% of the European Union’s coal generation over the first half of 2019.

Coal collapsed in other Western European countries as well, declining by 79% in Ireland to eventually provide less than 2% of the electricity mix – a figure repeated in France and the United Kingdom as well, the latter of which experienced a mammoth 18-day run without coal generation. Coal generation provided only 6% in Spain and Italy.

The reason for coal’s dramatic decline over the first half of 2019 was due in part to coal being replaced by wind and solar generation capacity – which accounted for half of coal’s decline – and coal being replaced by natural gas – which accounted for the other half of coal’s decline. As already mentioned, wind and solar increased their electricity generation by 30 TWh (as did natural gas).

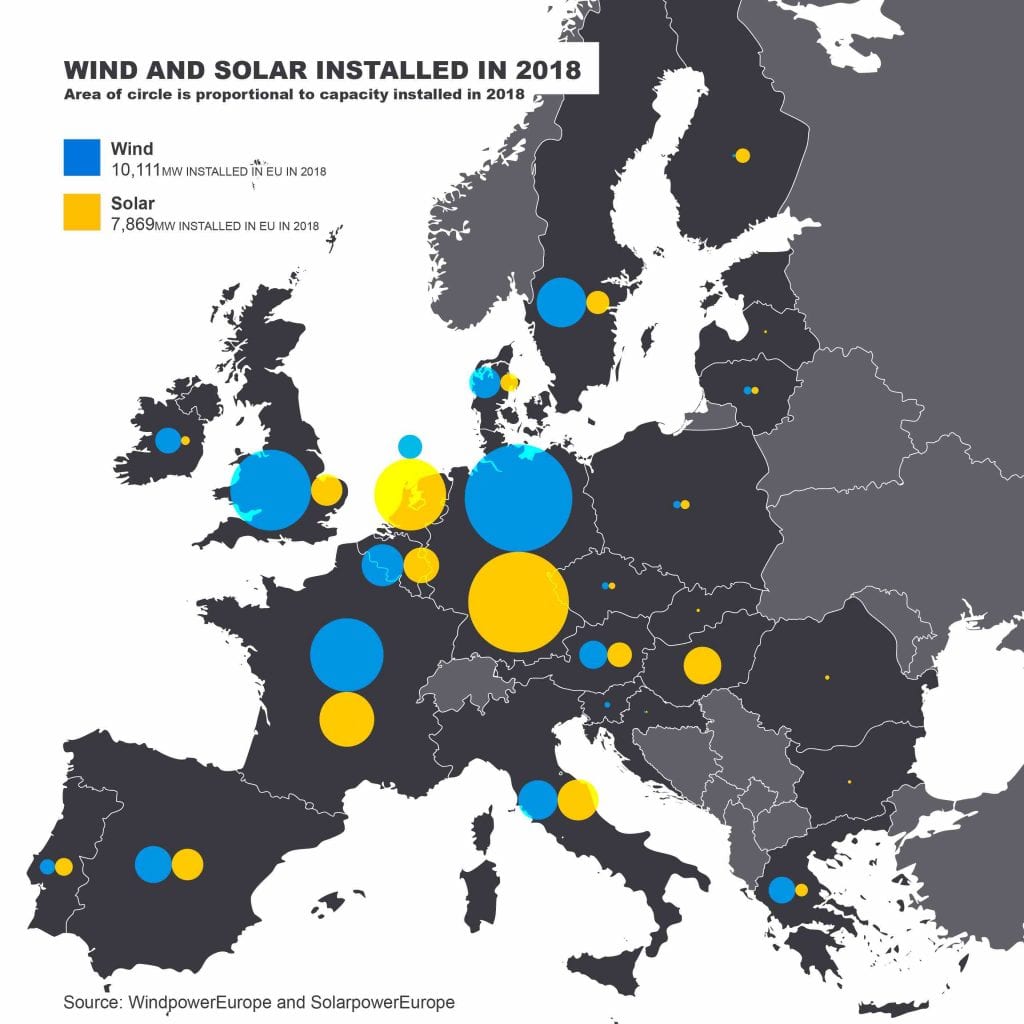

Eastern European countries, however, saw much smaller declines in coal generation, and this is due largely to a lack of wind and solar deployments.

Only 5% of wind and solar installed in 2018 was in Eastern Europe, and those countries intent on burning lignite coal did particularly badly: Out of the 17 GW of wind and solar installed in 2018 across Europe, Poland installed only 39 MW, Czechia 26 MW, Romania 5 MW, and Bulgaria 3 MW.

There were declines, however, with coal falling by 6% in a traditionally coal-dominant Poland – thanks to a new gas plant coming online at Plock – while coal generation collapsed by 16% in Greece, where natural gas generation increased.

Unfortunately, coal generation rose slightly in both Slovenia and Bulgaria.

With the mixed bag of decreases and increases across the 28 Member States of the European Union, Sandbag expects that, even if coal’s decline continues through 2019, coal generation will still nevertheless account for 12% of the EU’s 2019 greenhouse gas emissions.

Source: RenewEconomy