- The world’s largest crypto exchange, Binance, is flush with massive profits from its operations in 2018, estimated from buybacks of its BNB token to total $446 million.

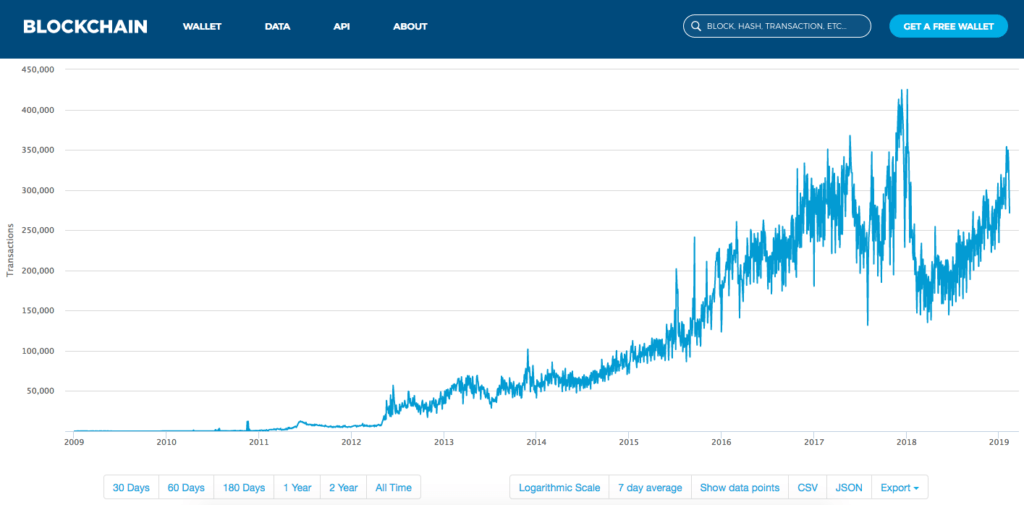

- Although Bitcoin is trading at a loss over the last 12 months, transaction volume has been steadily increasing over the last year, so Binance has been busy.

- “To date, even in this bear market, we still run a profitable business,” Binance CFO Wei Zhou told CNBC in a phone interview Wednesday.

Binance is looking good in 2019.

Awash with cash from its 2018 operations, the world’s largest cryptocurrency exchange flexed some half a billion dollars in profits from last year’s business, using net proceeds to buy back its proprietary exchange token BNB in amounts and at prices that led one cryptocoin industry publication, The Block, to estimate Binance’s 2018 profits at $446 million for the year:

“So far, Binance has had six quarterly BNB burns, in which it destroyed a little over 10.8 million BNB. Every burn is done based on BNB price on the day of the burn, which means that if the BNB totals are multiplied by the price of BNB on the day of the burn, we can get a USD equivalent of 20% of the profits. Binance’s profit is simply five times the USD equivalent of each burn, if the firm is staying true to its whitepaper commitment.”

This Is What It’s Like To Use Private Currency

This is what deflationary currency looks like. It’s generous. It gives back to the people that use it instead of slowly, quietly stealing from them. Fiat currencies have been abused since ancient times by those who wield absolute control over them to siphon away wealth from their captive market of currency users.

Regular token buybacks and burns to harden up the tokens in everybody’s wallets and share back some of the wealth of its incredible success is Binance treating its customers well.

This is a sign of the era of free market finance, in which customers will have innumerable choices for banking, and private money entrepreneurs will face low barriers to entry for startups with something valuable to bring to the industry.

This is an economy in which corporate and consumer interests are more aligned, incentivizing companies like Binance not to leech off their customers’ money which would scare them away, but to pump up their customer’s money with token buybacks and regularly schedule burns to distribute back the burnings evenly into everyone’s BNB tokens.

Buyers and Sellers Have Been Keeping Binance Busy

It’s a good look for Binance.

Remarkably Binance has only been in existence for a very short time, since it was established in July 2017, but has swept into the burgeoning crypto industry as a major player in facilitating liquidity, raising $15 million in its initial coin offering (ICO) selling its tokens.

Although the crypto market bubble wrought devastating financial losses for the last person holding the hot potato in December 2017, and has spent the last year in steady decline, transaction volume has steadily increased over the last year.

So a lot of people are spending their bitcoin and other cryptos, cashing out, or moving to another asset class, betting the cryptocurrency market may continue to depreciate, but there are plenty of people lining up to buy bitcoin and other currencies off them, including people facing national currency crises as well as first-world savers and investors.

BNB Coins Turned $1 into $80 in 18 months

Binance quickly rose to become the world’s largest cryptocurrency exchange following its launch in mid-2017. | Source: Shutterstock

Raising $15 million through the ICO, the total market cap of Binance Coin (BNB) today is in excess of $1.2 billion. There are lots of examples of money lost in the private digital coin economy, but there will continue to be new opportunities and great success stories happening in this space.

Those who bought BNB turned $100 into $8,000 in under two years. Again, this is what it can be like to do business with private currency. These regular burns of BNB coin to pump up the value of the ones people are holding are the work of a private currency company that cares about keeping its currency strong for those who use it.

It’s the opposite of what central banks like the Federal Reserve do, weakening their fiat currencies like the U.S. Dollar every year as a matter of policy, to make people have to get rid of their ever-weakening dollars as fast as possible for anything else: to pay their bills, to buy business equipment, supplies, and consumer goods – even a margarita maker – rather than keep their wealth in decaying cash, and if there’s any left to save, swap it for stocks or land.

This constant pressure of monetary expansion realigns the economic incentives of the entire economy in a fundamental way, because capital markets are the backbone of the modern economy, the fuel that powers the engine of capitalism.

Because the central bank is constantly creating and lending out new money at artificially-low interest rates while devaluing the rest of the currency, people come to rely on cozying up to the central bank for some of the relentless flow of credit.

This doesn’t, however, keep people using fiat currencies as a matter of enticement through value proposition, but as a matter of necessity for damage mitigation from the weak currency policies of the Federal Reserve and other socialist central banks.

Featured Image from REUTERS / Darrin Zammit Lupi

Source: Crypto New Media