IOTA (MIOTA) is currently the 10th largest crypto project in the world by market cap and trades at $0.78. At one point in its life cycle it traded as high as $5.143 and was the 4th largest crypto in the world by market cap.

While it is down 85% from its all time high, IOTA has performed strongly in the last two weeks, with price rising an impressive ~ 86% since August 14th. The token’s fortunes have been buoyed by a short term crypto bull market, and recent announcements like an expansion to its ongoing Fujitsu partnership. Believers in the IOTA project will hope that the network can build on this short term momentum.

Taking a macro view, though, the bigger picture is less rosy. With trading volumes down ~98% from all time highs and a raft of fundamental concerns still plaguing the network, it’s a long road back for IOTA to reclaim its position as a blockchain darling.

Exchanges and trading pairs

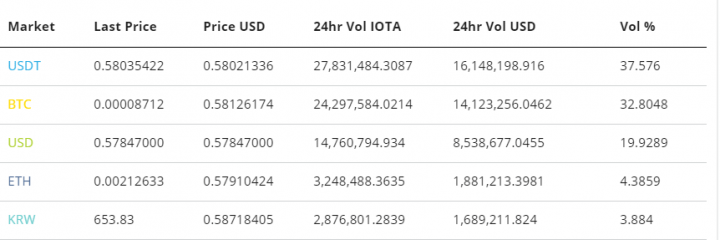

The two most popular pairs for trading IOTA are crypto-to-crypto with the USDT/IOTA and BTC/IOTA pairs currently making up close to 70% of total daily volume. The next most popular pair is the fiat USD/IOTA pair, which at present is only offered by Bitfinex and is the exchange’s 4th most popular trading option.

The most popular exchange offering the USDT/IOTA trading pair is mega exchange Binance, which handles close to 20 million IOTA between the pair daily, worth over 11 million USD. Other popular exchanges for the pair are Binance’s traditional rivals in the crypto-to-crypto marketplace Okex and Huobi.

The tangle model

The core goal of the IOTA project is to create a business focused machine-to-machine distributed ledger transaction system using Internet of things (IOT) applications. In order to deliver this solution, IOTA implements a blockchain alternative called the tangle which promises zero fee transactions, full scalability and minimal processing power usage.

‘The tangle’ uses an existing mathematical concept, the Directed Acyclic graph, and is centered on the idea of self-verifying transactions. There are no miners in the tangle and the differences between verifiers and transactors are removed. In order for a transaction to be confirmed, a sender needs to confirm two unverified transactions (called ‘tips’) on the tangle

This means there is no ‘chain’ in IOTA, with the network expanding outward like a web, playing into the DLT’s scalability solution. The more transactors and IOT nodes operating within the tangle, the more potential ‘tips’ there are for a sender to interact with, in theory making IOTA fully scalable. ‘Blocks’ are also eliminated in IOTA, because individual transactions are being verified, rather than blocks of transactions being published.

A mini-POW interaction occurs when a node/sender confirms the two other transactions (which are decided based on a random walk algorithm). Conceivably, the amount of processing power needed to carry out a double-spend, 33% attack on IOTA is minimal, because of the lightweight nature of transactions, and the subsequent simplicity of POW problems.

In order to mitigate for this potential issue, IOTA currently employs a coordinator node that checkpoints valid transactions, and notifies the network of these transactions, every minute. While the coordinator is a temporary solution described as training wheels, its biggest issue while in operation, is the loss of censorship resistance.

Currently, every IOTA transaction is being monitored by a centralized overseer. Ideologically this a serious concern because trustlessness is lost from the network.

Despite the temporary network stop-gap of using a coordinator, the theory and pitch behind the IOTA model remains digestible and logical. In essence, it is a progression of the blockchain concept that inherently addresses some of distributed ledger technology’s classic problems with a lightweight solution.

IOTA’s FUD

“I have nothing against the IOTA community, or DAG algorithms. I strongly disagree with many of IOTA’s technical decisions (trinary, custom hash functions, POW on transactions), and find some of their behavior deeply egregious to the point where it goes beyond mere negligence.”

Ethereum Core Developer Vitalik Buterin discussing IOTA

IOTA’s longer term challenges appear to stem from more granular issues. One of these, as referenced by Vitalik Buterin, is the choice by the IOTA team to use a custom-in house hashing function known as curl. Building a secure, attack resistant hashing function is known to be a notoriously difficult endeavour, with even powerhouse blockchains like Bitcoin and Ethereum borrowing hashing models, which have been through years of stringent testing.

The potential susceptibility of IOTA’s original encryption model has previously been pointed out in great detail. Issues such as collisions (different inputs linking to the same output), a potentially fatal flaw for any encryption system, have been known to occur with the curl. There were also problems surrounding the IOTA user experience, and a painful process of generating unreliable seeds

The IOTA team, to its credit, switched away from using curl in late 2017, switching to KECCAK, SHA-3 hashing model.

Despite the positive change, the episode led to a fair amount of FUD for the project, and question marks surrounding the competency of decision-making within IOTA’s leadership.

An ongoing issue with the Tangle, is the threat of side chain (side tangle) attacks. IOTA’s in-built tip assignment algorithm can be ignored, allowing senders to pick their own tips. Sidetangle’s are bunches of transactions floating around the tangle that only select tips which reference themselves, meaning they are not interacting with other nodes on the main tangle, allowing for the build up of a centrally controlled mass of transactions. If the sidetangle is able to interact with the maintangle, this can lead to heavy disruptions.

IOTA aims to avoid these potential headaches by designing the network so that maintangle nodes are always detached and avoid getting caught in the sidetangle.

However, hackers have developed software that allows large sidetangles to interact with the maintangle and disrupt its operations. This prevents regular users from carrying out their transactions, as they begin to interact with an artificial net that is controlled by a single, malicious source.

The result of a sidetangle’s invasion of the maintangle is a DDOS (distributed denial of service) scenario. Bugs in sidetangles were being found as recently as July, and the threat of new attacks continues to loom over IOTA.

Network summary

This confirmation rate is surprisingly low. It indicates that there are a significant number of bad/invalid transactions floating around the network – 1 in 5. ideally the confirmation rate should be 100% and apparently sat at 98% a few months ago. This figure is indicative of the progress IOTA still needs to make to become a fully fledged, distributed IOT based data transfer solution. In terms of a speed comparison, Monero – a network of comparable size – currently operates with a block production time of two minutes, and less than one transaction per second. Likely, one of the reasons IOTA is able to sustain such a high relative throughput is because of the earlier mentioned coordinator facilitating faster network activity.

Partnerships

Despite some of the network concerns, and the sputtering price of the IOTA/MIOTA token, the network’s ability to retain eye catching industry partnerships has remained a unique selling point.

IOTA’s focus on implementing acyclic IOT nodes, that don’t require a large amount of processing power, makes it a far more accessible option for industry adoption versus the complications of setting up a mining operation with Bitcoin or Ethereum.

For example, the released Proof-of-concept for the IOTA/Volkswagen partnership, where automobiles would act as data points and validators for live real world transactions, would probably not have been possible with a large PoW network because of their heavy processing requirements.

IOTA’s price performance in the last few days has been a stand out. On the 28th of August, for example, the price of IOTA rose ~18%, up ~14% vs BTC, which in turn rose ~4%.

A factor for this impressive performance has been recent support from International IT giant Fujitsu, which has an ongoing project to feed and secure internal information into IOTA data silos.

They expanded this partnership August 26th, releasing a new IOTA integration Proof-of-concept, adding more layers to the initial partnership, announcing plans to integrate the IOTA blockchain into manufacturing and supply chain verticals, leveraging its appeal as an immutable data storage option, useful for purposes such as auditing.

Technical analysis

Regression Channel and Long Term Trends

On the 1D chart, the death cross, using the 50 and 200 day EMAs, remains intact. Furthermore, the 50 day EMA is currently acting as resistance.

Despite the impressive bull trend since mid-August, the price of MIOTA is still contained within a negative linear price trend. The Pearson’s R Correlation between time and price of ~0.79 for 2018 (regression channel). Price bounced off ~$0.44 (dashed line) in mid-August and sits at $0.78 at time of writing. Even with the ~58% price leap in little more than two weeks, price during 2018 has consistently fallen lower as volatility continuously dampens, visualized by ATR.

Additionally, the volume flow indicator (VFI) has consistently remained beneath 0 since mid-June (black arrow), which visualizes the lack of demand volume as of late. The VFI interpretation is a value above 0 is bullish and below 0 is bearish, with divergences between price and oscillator being high probability signals.

Ichimoku Clouds with Relative Strength Indicator (RSI)

The Ichimoku Cloud uses four metrics to determine if a trend exists; the current price in relation to the Cloud, the color of the Cloud (red for bearish, green for bullish), the Tenkan (T) and Kijun (K) cross, Lagging Span (Chikou), and Senkou Span (A & B).

The status of the current Cloud metrics on the 1D frame with singled settings (10/30/60/30) for quicker signals is bearish; price is below the Cloud, Cloud is bearish, the TK cross is bearish, and the Lagging Span is beneath the Cloud and price.

A traditional long entry would occur with a price break above the Cloud, known as a Kumo breakout, with price holding above the Cloud. From there, the trader would use either the Tenkan, Kijun, or Senkou A as their trailing stop.

MIOTA is currently sitting at ~$0.78 and attempting a possible Kumo breakout. The price momentum behind MIOTA has been overwhelming during the past two weeks, but current RSI, 60, will be approaching overbought territory shortly. The current RSI metrics may indicate that MIOTA will have sufficient buying pressure to touch Cloud resistance or even enter the Cloud, but will ultimately fail. The support levels are $0.575 and $0.44. Price will need to break above $0.84 or $1 (depending on where it touches Cloud resistance) for a Kumo breakout. Price targets for a successful Kumo breakout are $1 and $1.46.

The status of the current Cloud metrics on the 1D time frame with doubled settings (20/60/120/30) for more accurate signals is bearish; price is below the Cloud, Cloud is bearish, TK cross is bearish, and the Lagging Span is beneath the Cloud and price.

Price needs to break and hold above $1.59 (flat Senkou B) for a successful Kumo breakout with the resulting price target of $1.77 (flat Senkou B). The negative linear trend, current RSI, and Momentum (dashed resistance line) indicator suggest that the probability of a successful breakout is low.

However, extremely risk-seeking momentum traders, may look favorably at the 4H chart where price is currently experiencing a Kumo breakout using (20/60/120/30) settings. Furthermore, traders may view a potential price dip to $0.71, Cloud support, and hold of that level, as a sufficient indicator to initiate a quick momentum trade with price targets of $0.83 and $0.97.

Conclusion

The IOTA project is a work in progress with some fundamental issues that affect the current stability of Tangle operations. A long term solution to the threat of DDOS and double spend attacks is yet to be clearly provided, and given that the network handles external user funds, these issues are not insignificant.

The network, however, remains an exciting concept. This factor along with already its established industry partnerships, means that if the full scope of its solution is ever realized, IOTA is likely worth far more than its current ~ $1.8 billion market capitalization.

The long term technicals for MIOTA are bearish, while the short term technicals since mid-August are bullish. Traders desperate to participate in the short term bull trend, may view the 4H chart with favorability and execute a trade with proper risk management, and risk-seeking price targets of $0.83 and $0.97. Both, the prudent short term trader (10/30/60/30) and longer term trader (20/60/120/30), on the 1D chart, will await a positive TK cross and Kumo breakout above ~$1 and $1.59, respectively, before entering a long position. Both trader’s support levels are $0.575 and $0.44 (critical to hold). The (10/30/60/30) trader’s price target is $1.46 and the (20/60/120/30) price target is $1.77.

Disclaimer: This analysis has been designed for informational and educational purposes only. Readers are advised to conduct their own independent research into individual assets before making a purchase decision.

About the authors

Christopher Brookins

Christopher Brookins is the founder and CEO of

, a quantitative investment firm focused on digital assets and blockchain technology. Chris has a deep knowledge and unique perspective on digital assets formed by his polymath experience in equity trading, credit investing, and business development at two West Coast startups (one acquired). He has been involved in the blockchain community since 2014.

Aditya Das

Aditya Das is Brave New Coin’s in-house market analyst. Raised in Dubai, UAE, he holds a post-graduate honors degree in Economics from the University of Auckland and a BA in Economics from the University of Sussex. Prior to joining BNC his most recent roles were as a researcher and Economics tutor at the University of Auckland. Follow @Quartlifecrypto

Source: Crypto New Media