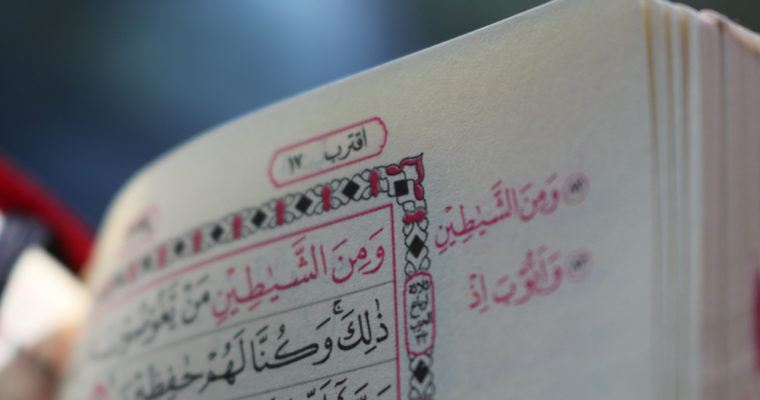

The issue of Islamic classification of cryptocurrency has been ongoing since the rise of bitcoin’s popularity, with debate over whether or not bitcoin and other cryptocurrencies are considered halal (permitted) or haram (forbidden).

This is due to the stringent guidelines regarding monetary classification laid out in the Muslim faith, with conditions forbidding usury (the act of lending for profit on interest) as well as currency backed by nothing considered to be of value. The fractional reserve banking practices which led to the 2008 global financial crisis and the collapse of the US housing market, for example, are completely forbidden by Islamic law, and Muslim bankers and financial professionals cannot engage in them in accordance with their faith.

CCN has covered previous cryptocurrency developments in Islam such as the first ever mosque in Britain to accept cryptocurrency for alms-giving and the declaration that bitcoin is halal, or Sharia-compliant, according to certain scholars. Today, further progress has been made with Swiss financial technology firm X8 AG becoming certified by Islamic scholars for its digital currency, a certification that will be necessary to accommodate the company’s planned expansion into the Middle East.

Many other fintech firms are applying for and pursuing Sharia-compliant recognition that will grant them access to the Muslim banking world, and Middle Eastern regulators and exchanges are equally open to attracting international business pending scholarly approval. The Accounting and Auditing Organisation for Islamic Financial Institutions (AAOIFI) conference of Sharia scholars met in Bahrain earlier this year with the classification of cryptocurrencies one of the major items on the agenda.

X8’s Ethereum-based cryptocurrency is backed by a basket of eight fiat currencies and gold, which helps the requirements for currency in terms of being backed by commodities or resources deemed to be inherently valuable. This distinction can be a shaky one — fiat currencies like the dollar are typically unbacked by gold these days and are simply deemed valuable by virtue of mainstream social acceptance and adoption, and indeed gold is valued higher than its utility as a conductor due to socially-held beliefs that it is a precious metal.

The Islamic requirement that cryptocurrencies are only valuable if society agrees may seem like a catch-22, but this is essentially a more formal version of the same process for Western valuation of cryptocurrency as well. In this case, X8’s cryptocurrency and related tokens have been certified by the Shariyah Review Bureau (SRB), an Islamic advisory firm licensed by Bahrain’s central bank.

X8 director and co-founder Francesca Greco said:

“The Gulf region is a really good place for financial technology companies, because they all want to become hubs for fintech,” adding the company would open a regional office in the Middle East later this month.”

Regional Gulf regulators have encouraged fintech innovation over the past few years but are still wary of cryptocurrencies, which Greco states is an opportunity for stablecoins to step in and fulfill their use case of reducing volatility. Equally, Switzerland has embraced blockchain with open arms, establishing the small city of Zug as one of the world’s leading blockchain hubs, collaborating with other nations on blockchain regulation, and rolling out blockchain voting prototype systems.

Images from Shutterstock

Follow us on Telegram or subscribe to our newsletter here.

Source: Crypto New Media