If you’re involved in the cryptocurrency space, it doesn’t take long to come across the term “Market Cap”. In this guide, I’ll define the term and explain why it’s so important in the world of cryptocurrencies.

What does Market Cap Mean in Crypto?

Market Cap, short for market capitalization, is quite simply the circulating supply of a cryptocurrency multiplied by its current price. This is an important metric because it’s what we most often use to rank cryptocurrencies by their relative sizes.

Market Cap = ( Circulating Supply X Price )

Those new to the cryptocurrencies world will often compare prices when trying to determine a relative size between different coins. This is a poor approach and is even used by some to mislead potential investors. Purely looking at prices does not take into account the difference in available coins among cryptocurrencies.

(View our Market Cap Explanation on YouTube)

We’ve written an entire guide on circulating supply, but put simply, this is the current amount of technically available coins for a given cryptocurrency.

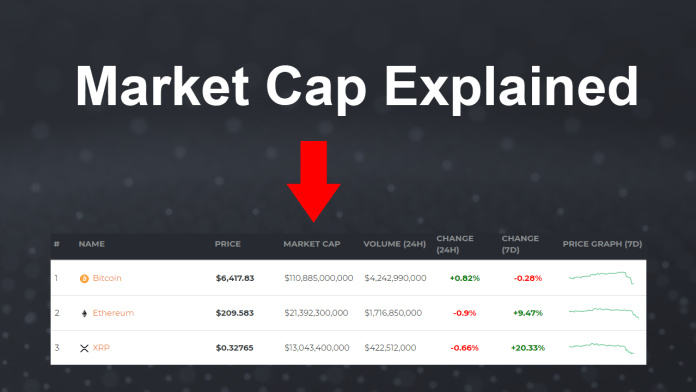

In the below image, we compare the current top 3 coins ranked by market cap. If comparing price, you’ll find Bitcoin (BTC) has a price more than 19,000X greater than ripple XRP. However, this doesn’t take into account that there are 39,792,720,000 more XRP than there are BTC in circulation.

By factoring in circulating supply, we see that Bitcoin’s market cap is only 8.58X greater than XRP.

To illustrate this point more clearly, let’s imagine Bitcoin, Ethereum, and XRP all had the same market cap. While this would be our best estimation that these coins have the same amount of investment into them, the prices would still be drastically different.

This does NOT mean Ripple is “cheap” or a comparatively good investment opportunity solely based off of its far lower price.

It’s also important to realize Bitcoin is divisible to 8 decimal places, the smallest of which is called a Satoshi. 1 Satoshi is currently worth $0.0000641745. If the world collectively decided to move the decimal point 8 places and used this to represent Bitcoin, this would not change the value that’s been invested into Bitcoin. This also means there’s nothing limiting someone to make a modest investment of $20 into Bitcoin, the same way they’d be able to do with Ripple.

Lastly, I do have to admit that the price of a cryptocurrency clearly has a psychological impact on some novice cryptocurrency investors. While this can impact their personal investment decisions, it’s a fallacy to think a difference in price alone can necessarily demonstrate that a given cryptocurrency is worth less as a whole.

Circulating Supply Issues and Their Impact on Market Cap

While market cap is our best estimation of relative size for cryptocurrencies, it’s not perfect. This is largely a result of imperfections in circulating supplies.

Former BitGo engineer and Bitcoin proponent Jameson Lopp, has estimated that 4 million Bitcoins have been lost. This is primarily a result of early adopters who mined or purchased large amounts of the coin, then lost their hard drives or private keys. Unfortunately, nobody actually knows the exact amount of Bitcoin or other cryptocurrencies that have been lost. Therefore, lost coins are not excluded from circulating supplies.

It’s important to consider that some amount of lost coins exist for nearly every cryptocurrency. However, you could estimate that Bitcoin, being the oldest cryptocurrency, has the most lost coins of any major cryptocurrency. If we could say with 100% certainty that 4 million Bitcoins were lost, then Bitcoin’s current market cap would only be $85 billion. With that said, it would still firmly be the largest coin by market cap.

Newly Created Coins Impact on Market Cap

For most cryptocurrencies, their current circulating supplies do not indicate the total number of coins that will ever be in circulation. With Bitcoin, for example, mining will continue until 21 million coins have been created. If new coins create more supply than there is demand, this could decrease the price to a point where the market cap also lowers.

With that said, ICOs often create more extreme possibilities.

Initial coin offerings (ICOs) exploded in popularity from late 2017 to present day. Often in ICOs, you’ll see those project founders, early investors, and/or advisors are given tokens to be released at a later date. These tokens are considered to be a part of a cryptocurrency’s total supply, but not its circulating supply. Once these coins are released to use, they become a part of the cryptocurrency’s circulating supply.

Let’s look at a hypothetical example ICO #1:

- Yesterday, ICO #1 had a circulating supply of 1,000,000 coins, a price of $2, and a thus a market cap of $2,000,000 (1,000,000 * $2).

- Today, 250,000 tokens were together released to founders, making the new circulating supply 1,250,000. If the price stays the same at $2, ICO #1’s market cap will now be $2,500,000 (1,250,000 * $2). In other words, it’s increased by $500,000.

Now, let’s look at an example ICO #2, where the increased flood of tokens significantly reduced the price of the token due to a far greater supply than demand. To me, this seems like a more likely scenario than in ICO #1:

- Yesterday, ICO #2 had a circulating supply of 1,000,000 coins, a price of $2, and a thus a market cap of $2,000,000 (1,000,000 * $2).

- Today, 250,000 tokens were together released to founders, making the new circulating supply 1,250,000. The price has dropped to $1.50, due to the increased supply of tokens relative to buyer demand. The market cap for ICO #2 is now $1,875,000 (1,250,000 * $1.5). In other words, the decrease in price out paced the newly added tokens, thus resulting in a $125,000 loss in market cap.

Keep in mind these numbers in the above example are arbitrary.

Summary

While market cap is by no means perfect and can very suddenly change by altering a coin’s circulating supply, it’s still widely considered the best metric we have available to rank coins and compare their overall values.

One thing is for certain when looking to compare the size of cryptocurrencies, the market cap is always a better metric than price.

The post Market Cap Meaning for Cryptocurrency and Why it’s Important appeared first on UNHASHED.

Source: Crypto New Media