Cryptocurrencies (or cryptos) captured the world’s imagination during the last couple of years. From their spectacular rise in 2017, to their equally hard fall in 2018, and to their most recent revival this year. Cryptocurrencies and the blockchain technology powering them are regarded as disruptive forces, proposing an alternative decentralized monetary system. They have also gathered their fair share of criticism. Cryptocurrencies are accused of facilitating transfer of “dirty money” between criminals. They provided mind-boggling returns a couple years back and earned the reputation of being a “get rich quick” scheme.

In this article, we turn our attention to cryptocurrencies as investment vehicles sharing common characteristics with other asset classes like FX, commodities and precious metals. Cryptocurrencies, like fiat currencies, allow for easy transfer of wealth between individuals and businesses. They are similar to commodities with regards to the limited supply they offer. Cryptocurrencies have drawn comparisons to gold which is viewed as a “safe-haven” investment.

This is the second part of the article where I will present how to implement a trading strategy using cryptocurrency pairs, and backtest it using the collected dataset in the previous article.

We implement a trading strategy inspired from E. Chan’s pair-trading strategy involving gold and gold miners ETFs. After money is injected to traditional markets like equity and fixed-income, it will eventually overflow into alternative asset classes like cryptocurrencies. We suppose that money flowing to cryptocurrencies will drive their prices together.

The price movement between two cryptocurrencies is measured by the difference in their prices or spread.

If the spread is mean-reverting, then we can buy (sell) when the spread is low (high).

We have the following rules for our pair-trading strategy:

- Enter a long position on the spread if it is below -1 STD.

- Enter a short position on the spread if it is above 1 STD.

- Exit the position if the spread is greater than -0.5 and less than 0.5 STD.

- Load the historical data.

- Implement and backtest the trading strategy.

- Analyze the performance of the pair-trading strategy.

You can find the code on https://github.com/DinodC/pair-trading-cryptos.

Import packages

import numpy as npimport pandas as pdfrom pandas import Series, DataFrameimport pickleimport matplotlib.pyplot as pltimport statsmodels.api as sm%matplotlib inline

Load the historical data

with open('data_coinmarketcap.pickle', 'rb') as f: data = pickle.load(f)f.close()

Create close prices DataFrame object

close = pd.DataFrame({'BTC': data.BTC.Close, 'ETH': data.ETH.Close, 'LTC': data.LTC.Close, 'XRP': data.XRP.Close})Create an id for Bitcoin, Ethereum, Litecoin and Ripple cryptocurrencies to USD.

id = ['BTC', 'ETH', 'LTC', 'XRP']Before implementing the pair-trading strategy, recall in a previous article the things to look out for when backtesting:

- Data-snooping bias

- Look-ahead bias

- Transaction costs

I will review these pitfalls and propose solutions to mitigate their effect on the backtesting results.

Data-snooping is the use of data analysis to find statistically significant patterns when in fact they are not.

It can originate from overfitting the model to a dataset by increasing the number of its parameters.

Data-snooping can also come from optimizing trading decisions e.g. choosing entry and exit thresholds.

To mitigate data-snooping bias, we can do the following:

- Out-of-sample testing:

Out-of-sample testing involves separating historical data into a training and testing set.

We optimize the model’s parameters using the training set, and validate it on the testing or out-of-sample set. - Paper trading:

Paper trading share the same idea as out-of-sample testing in separating the dataset.

We optimize the model’s parameters using the historical data, and run it using incoming actual data.

In this article, we apply out-of-sample testing by dividing the data into two equal sets.

# Define training set training_start = '2015-08-07' training_end = '2017-08-01' training_set = close[training_start:training_end]# Define testing set testing_start = '2017-08-02' testing_end = '2019-05-21' testing_set = close[testing_start:testing_end]

Look-ahead bias is the use of information not yet available at the moment the trade was recommended. An example is calculating the trading signal based on the day’s highest or lowest price. As the day’s high and low are only available at close, we correct this by lagging our historical data.

Another way to mitigate look-ahead bias is the following check:

- Backtest using historical data and save the positions.

- Backtest using truncated historical data, e.g. 10 days, and save the positions.

- Truncate the positions from point 1, e.g. 10 days, compare with the positions from point 2.

Note that the implementation of this check is just after the backtesting.

Transaction costs make the backtest more realistic.

They deflate a trading strategy’s performance by including the following:

- Slippage is the difference between your expected price and the executed price.

- Commission fee is a service charge extracted by your broker for handling your purchases.

- Market impact is the price effect you generate each time you pass a considerable order to the market.

In this article, we assume a round-trip transaction cost of 10 BPs per trade.

# Round-trip transaction cost per trade round_trip = 0.0010We define the entry and exit thresholds

entry_threshold = 1 exit_threshold = 0.5We implement the pair-trading strategy

# Set crypto 1 to BTC crypto_1 = id[0]# Initialize output output = {id[1]: {}, id[2]: {}, id[3]: {}}for i in range(1, len(id)):# Set crypto 2 to ETH, LTC and XRP crypto_2 = id[i]# Calculate the hedge ratio using the training set model = sm.OLS(training_set[crypto_1], training_set[crypto_2]) result = model.fit() hedge_ratio = result.params[crypto_2]# Calculate the spread spread = close[crypto_1] - hedge_ratio * close[crypto_2] # Mean of the spread on the training set spread_mean = spread[training_start:training_end].mean() # Standard deviation of the spread calculated on the training set spread_std = spread[training_start:training_end].std() # Z-score of the spread z_score = (spread - spread_mean) / spread_std# Implement pair trading strategy # Create masks for long, short and exit positions longs = (z_score <= -entry_threshold) shorts = (z_score >= entry_threshold) exits = (np.abs(z_score) <= exit_threshold) # Initialize the positions positions = pd.DataFrame({crypto_1: np.nan * pd.Series(range(len(z_score))), crypto_2: np.nan * pd.Series(range(len(z_score)))}, index=z_score.index) # Update the positions [positions[crypto_1][longs], positions[crypto_2][longs]] = [1, -1] [positions[crypto_1][shorts], positions[crypto_2][shorts]] = [-1, 1] [positions[crypto_1][exits], positions[crypto_2][exits]] = [0, 0] # Carry forward the positions except when there is an exit positions.fillna(method='ffill', inplace=True) # Lag the positions to the next day because we base calculations on close positions = positions.shift(periods=1)# Calculate the performance # Initialize the returns returns = pd.DataFrame({crypto_1: close[crypto_1], crypto_2: close[crypto_2]}) # Update the returns returns = returns.pct_change() # Calculate the pnl pnl = returns * positions# Calculate transaction costs # Create a mask to indicate changes in position mask = (~np.isnan(positions.BTC) & (positions.BTC - positions.BTC.shift(periods=1)).astype(bool)) # mask = (~np.isnan(positions.BTC) & (positions.BTC != positions.BTC.shift(periods=1))) # Create a transaction costs Series tc = pd.Series(np.zeros(len(mask)), index=mask.index) tc[mask] = - round_trip# Update pnl DataFrame pnl['TC'] = tc # Calculate net pnl pnl_net = pnl.sum(axis='columns')# Calculate the Sharpe ratio under the training set sharpe_training = np.sqrt(252) * pnl_net[training_start:training_end].mean() / pnl_net[training_start:training_end].std() # Calculate the Sharpe ratio under the testing set sharpe_testing = np.sqrt(252) * pnl_net[testing_start:testing_end].mean() / pnl_net[testing_start:testing_end].std()# Generate the output # Gather data data = {'spread': z_score, 'positions': positions, 'pnl': pnl_net, 'sharpe training': sharpe_training, 'sharpe testing': sharpe_testing, } # Update the output output.update({crypto_2: data})

Load the output generated from the truncated historical data

with open('output_truncated.pickle', 'rb') as f: output_truncated = pickle.load(f)f.close()positions_truncated_eth = output_truncated['ETH']['positions'].dropna() positions_truncated_ltc = output_truncated['LTC']['positions'].dropna() positions_truncated_xrp = output_truncated['XRP']['positions'].dropna()

Truncate the positions calculated from the full dataset

positions_eth = output['ETH']['positions'][:-100].dropna() positions_ltc = output['LTC']['positions'][:-100].dropna() positions_xrp = output['XRP']['positions'][:-100].dropna()Compare the two sets of positions

mask = positions_eth.eq(positions_truncated_eth) mask.ETH.value_counts()True 1216 False 5 Name: ETH, dtype: int64mask = positions_ltc.eq(positions_truncated_ltc) mask.LTC.value_counts()True 2118 False 5 Name: LTC, dtype: int64mask = positions_xrp.eq(positions_truncated_xrp) mask.XRP.value_counts()True 2020 False 5 Name: XRP, dtype: int64

Recall that the spread between BTC and other cryptocurrencies provides the signal of our trading strategy.

Plot the spread

plt.figure(figsize=[20, 20])# Spread BTC & ETH # Training set plt.subplot(3, 2, 1) plt.plot(output['ETH']['spread'][training_start:training_end]) plt.title('Spread BTC & ETH - Training Set') plt.xlim(training_start, training_end) plt.ylim(-10, 40) # Testing set plt.subplot(3, 2, 2) color = 'tab:orange' plt.plot(output['ETH']['spread'][testing_start:testing_end], color=color) plt.title('Spread BTC & ETH - Testing Set') plt.xlim(testing_start, testing_end) plt.ylim(-10, 40)# Spread BTC & LTC # Training set plt.subplot(3, 2, 3) plt.plot(output['LTC']['spread'][training_start:training_end]) plt.title('Spread BTC & LTC - Training Set') plt.xlim(training_start, training_end) plt.ylim(-30, 40) # Testing set plt.subplot(3, 2, 4) color = 'tab:orange' plt.plot(output['LTC']['spread'][testing_start:testing_end], color=color) plt.title('Spread BTC & LTC - Testing Set') plt.xlim(testing_start, testing_end) plt.ylim(-30, 40)# Spread BTC & XRP # Training set plt.subplot(3, 2, 5) plt.plot(output['XRP']['spread'][training_start:training_end]) plt.title('Spread BTC & XRP - Training Set') plt.xlim(training_start, training_end) plt.ylim(-50, 50) # Testing set plt.subplot(3, 2, 6) color = 'tab:orange' plt.plot(output['XRP']['spread'][testing_start:testing_end], color=color) plt.title('Spread BTC & XRP - Testing Set') plt.xlim(testing_start, testing_end) plt.ylim(-50, 50)

Remarks:

- On the training set, the spread between BTC and other cryptocurrencies is flat except for January to July 2017 where it exhibited mean-reversion.

- On the testing set, the spread between BTC and other cryptocurrencies shot up at the end of 2017 before falling down at the start of 2018.

- Comparing the spread under the training and testing sets, there seem to be two different underlying processes i.e. a regime change.

Create a Sharpe ratio table

sharpe = pd.DataFrame({'BTC & ETH': [output['ETH']['sharpe training'], output['ETH']['sharpe testing']], 'BTC & LTC': [output['LTC']['sharpe training'], output['LTC']['sharpe testing']], 'BTC & XRP': [output['XRP']['sharpe training'], output['XRP']['sharpe testing']]}, index=pd.MultiIndex.from_product([['Sharpe Ratio'], ['Training Set', 'Testing Set']]))Remarks:

- On the training set, trading pairs BTC & ETH, BTC & LTC and BTC & XRP generated good Sharpe ratios, higher than 1.

- On the testing set, the pair-trading strategy generated lower Sharpe ratios than the training set.

- We limited data-snooping bias but performance degraded in the testing set due regime change.

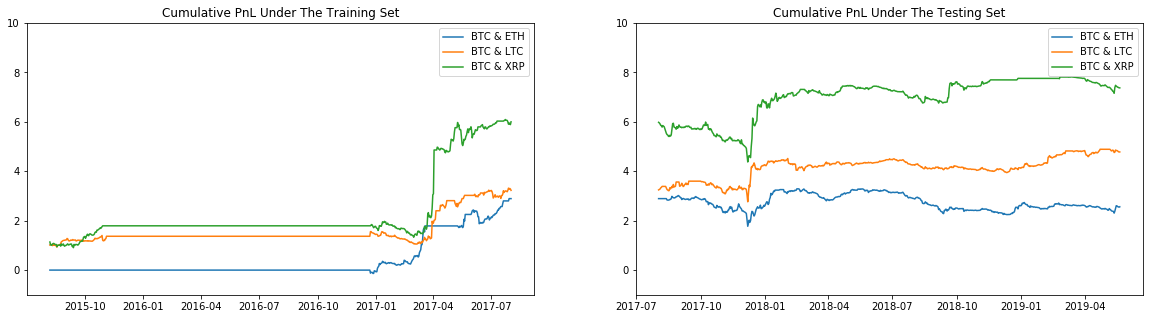

Plot the cumulative pnl

plt.figure(figsize=[20, 5])plt.subplot(1, 2, 1) plt.plot(output['ETH']['pnl'].cumsum()[training_start:training_end]) plt.plot(output['LTC']['pnl'].cumsum()[training_start:training_end]) plt.plot(output['XRP']['pnl'].cumsum()[training_start:training_end]) plt.title('Cumulative PnL Under The Training Set') plt.legend(['BTC & ETH', 'BTC & LTC', 'BTC & XRP']) plt.ylim(-1, 10)plt.subplot(1, 2, 2) plt.plot(output['ETH']['pnl'].cumsum()[testing_start:testing_end]) plt.plot(output['LTC']['pnl'].cumsum()[testing_start:testing_end]) plt.plot(output['XRP']['pnl'].cumsum()[testing_start:testing_end]) plt.title('Cumulative PnL Under The Testing Set') plt.legend(['BTC & ETH', 'BTC & LTC', 'BTC & XRP']) plt.ylim(-1, 10)

Remarks:

- On the training set, trading pairs BTC & ETH, BTC & LTC and BTC & XRP made profits from January to July 2017.

- On the test set, pair-trading strategy generated small profits during fall in January 2018.

- Lower profits in the testing set is due to regime change observed in the spread.

In this article, we implemented and backtested a pair-trading strategy using cryptocurrencies such as BTC, ETH, LTC and XRP. We limited data-snooping in our backtest by applying out-of-sample testing. We mitigated look-ahead bias by truncating the historical data. Transaction costs were included in the backtest to make it closer to reality.

Source: Crypto New Media