What is Bitcoin

It seems uncommon to read a newspaper or a magazine, (especially an online one), without seeing a mention of Bitcoin. Bitcoin has grabbed the attention of millions of people worldwide. But, it seems many people know Bitcoin because of its price rise. Or as a result hearing of people getting rich off of holdings. Others know it as vaguely anti-establishment or anti-government. It seems though that few have an in-depth understanding or appreciation of its workings and its potential.

With anything talked about as much as Bitcoin there is a danger of a “bandwagon effect”. That is, people and organizations diving in to use it without much of an understanding. This article aims to bring a little further insight into pros and cons of Bitcoin use. It will stay away from delving into the technological details.

Bitcoin is a crypto-currency. But you knew that already. What is a crypto-currency? How does it differ from electronic commerce that had been undertaken before?

In its simplest form, Bitcoin allows for peer-to-peer transfer of electronic cash. Yes, we could do that before using bank wires or banking apps. But that always required the use of a bank in the middle of the transaction. “Peer-to-peer” means that it is direct and there is no need for an organization in the middle. This means that you can send money anywhere. You can sent it across borders without roadblocks or reporting obligations.

Block-chain technology

Sending electronic funds creates a security concern. Security, along with transaction record keeping, has kept the banks in business. It is one of the main reasons why having a bank as an intermediary had been important in the past. The new “block-chain technology” changes the playing field. Messages of transfer are digitally-signed using public key cryptography. Transactions form part of the digital “ledger” and are public. Transaction details are recorded on the “block-chain”. The block-chain ledger is distributed to the computers of all involved in the transaction. This means that all transactions are “verified”. You know that your transaction made it to the intended recipient.

Block-chain technology is very interesting. Many industry pundits are predicting that it will be the most disruptive technology over the near to moderate future. It will likely change banking and many other industries as well. It is important to understand that block-chain technology is separate from Bitcoin. Bitcoin uses it, yes, as do the other hundreds of crypto-currencies out there. But we should not conflate Bitcoin with block-chain.

Where do Bitcoins come from

Many people own Bitcoin but do not understand it. They do not have a good understanding of where the underlying value comes from. Bitcoins are “mined” through a very difficult mathematical transaction process. As each new coin is mined the math becomes harder so it becomes more and more difficult to get further coins. There is an absolute top end allowed by the algorithms of 21 million Bitcoins. While that sounds limiting, each Bitcoin can be sub-divided. It can be sub-divided into parts as small as one-hundred-millionth (known as a “Satoshi”). But the point is that it is a limited resource. It is this scarcity that supports the valuation.

At one time “mining” of Bitcoins was a very easy process if you had a fast computer. That is no longer the case. The fact that the mathematics gets continually more complex changes things. Mining now takes many resources. It is now the case that mining is not profitable unless done in an area with very cheap electricity. Otherwise, the electricity costs of running a computer to “mine” for Bitcoins exceeds the value of what can be mined.

The Technology is Cool…

There is no doubt that the technology is cool. Actually, for those with an interest in Information Technology, it is EXTREMELY cool. Much of the excitement relates to the block-chain technology. Block-chain technology can exist and grow and be disruptive with or without Bitcoin. But in fairness, Bitcoin has gone further than simple use of the technology. Bitcoin has added in innovative processes to create a compelling product. Most of the other crypto-currencies have borrowed their central concepts from Bitcoin.

Both Bitcoin and block-chain will be worthy of careful future observation. They should be watched to see how these technologies play out. These technologies are sure to disrupt banking and other industries.

The Bitcoin bubble

Even the most ardent Bitcoin supporter must admit that we are in a Bitcoin bubble. Yes, there are people who regularly use Bitcoin for certain of their monetary transactions. There are others who understand the inner workings of Bitcoin and the scarcity created by the algorithms. These individuals see Bitcoin as a reasonable investment opportunity. Unfortunately, though, most Bitcoin investors are sucked in by rising price graphs and the opportunity to make a quick buck. This is a classic bubble. Investors investing only for the opportunity and not understanding or even caring exactly what they are buying. Think tulips in Holland in the 1600s.

Actually, Bitcoin could be worse than tulips and, without doubt, worse than a housing bubble. At least if a house value crashes you can still live in it. There is no intrinsic value to a Bitcoin. It is not guaranteed by a government or even a company. Its value is only maintained because of the demand of others.

Why public sector organizations should not use Bitcoin

It is cool technology and there is no doubt a place for block-chain technology in our futures. At present, the main focus of crypto-currencies seems to be as investment vehicles. At some point we expect this to shift. We expect crypto-currencies to gain traction as instruments for transactions. But at this point, Bitcoin is not ready for primetime. This is particularly the case for for public sector organizations.

Why Public Sector Organizations Should Not Use Bitcoin

- It is anonymous (technically “pseudo-anonymous”)

- The price is highly volatile

- Senior governments and tax authorities are not fond of it

- It is not backed by any government

- There is no recourse for fraud or theft

Bitcoin is Anonymous

For many users, the anonymity offered by Bitcoin is one of its most significant positive factors. This a confusing area. Through the “block-chain”, everyone involved can see every transaction. This sounds like the opposite of anonymous. But it is the user-names (technically their crypto “keys”) that are visible. You do not know who the keys belong to. This is what it means to be “pseudo-anonymous”. You know which user-name received or sent the funds. But you do not necessarily know the entity behind the user-name.

The anonymity of transaction partners is not a good thing in the public sector.

For payments:

- you do not know who you are paying unless a vendor has explicitly shared their public key with you

- you may be helping them create an off-book transaction

- difficult to know if the money is staying in Canada or going outside

For receipts:

- you do not know where the money comes from — is it the result of money laundering?

Bitcoin Price is highly volatile

The price swings in Bitcoin value have been dramatic. Yes, the price trend is up, but there have also been periods of steep decline. Below is a graph of the value of Bitcoin to the US$ over the period 2012 to 2017.

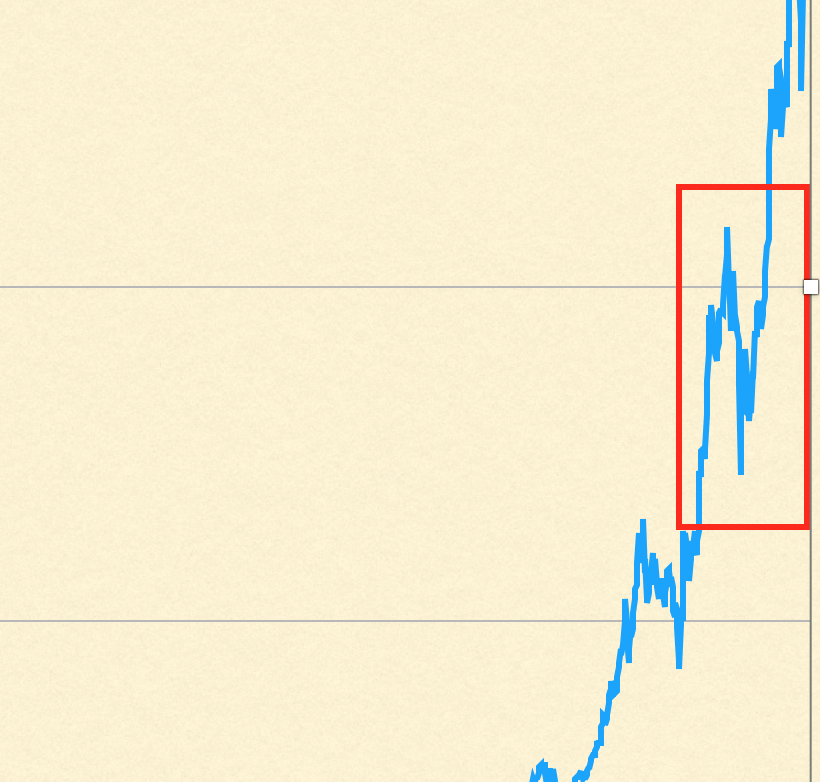

Here is an enhancement of the period of early September 2017 where the price dropped 34% over a week.

Yes, the Bitcoin price has recovered from the above setback and other setbacks it has seen. There is always concern about how increased government regulation would impact price. And there may or may not be a bubble. Public sector entities owe it to their stakeholders to operate in a prudent and conservative manner. Bitcoin holdings do not meet these criteria.

Senior governments and tax authorities do not like Bitcoin

Senior governments and tax authorities do not like Bitcoin because:

- no real way to tell if money is crossing borders

- uncertain how such transactions should or could impact money supply

- no way to tell if income from transactions is being reported

- no audit trail beyond block chain

Should a public sector organization consider concerns of senior government? Should they care about tax authorities dislike of Bitcoin? Well, yes, they should. Public sector organizations are part of the government peer group. They should lead by example and be good corporate citizens.

Also, extended use of Bitcoin in the economy could lead to lower government revenues. This has potential to harm all public sector organizations.

Bitcoin is not backed by any government

The fact that Bitcoin is not backed by a government has been trumpeted as an advantage. The argument is that the central banking authorities in the developed world led us into the Financial Crisis of 2008. These central authorities can no longer be trusted and/or are no longer relevant. Such thoughts play on libertarian desires of entrepreneurs. They play on the anti-establishment feelings of youth. But they are nonsensical. Bitcoin will not have any impact on the need to set interest rates, to track economic activity and to oversee markets.

Not only is there no government backing of Bitcoin, there is no central authority of any kind. The writer had a first-hand experience of this. The writer attempted some minor Bitcoin trades as research to support this article. As part of a “know your client” rule, this particular automated exchange demanded an upload of the writer’s passport. This was already a scary proposition given the potential for identity theft. But the automated system seems to have misread the birthdate. It has assumed the writer is under 18 years of age. The system allowed the writer to buy Bitcoins. But it will not allow their sale because the system “does not allow accounts for those under 18 years of age”. As of the date of this writing, more than 3 months from the buy date, this situation is still not resolved. With no central authority for recourse, it can be very problematic if things go wrong.

But it is the lack of government backing that is most problematic. The value of Bitcoin results from general agreement that there is value in an increasingly difficult algorithm. If that were to change, or if other crypto-currencies take precedence, the value of Bitcoin could go to zero. Think of what happened to “MySpace” once “Facebook” came out. MySpace was once valued at over $12 billion. When sold in 2011 the proceeds were only $35 million. Could something similar happen to Bitcoin?

These types of risks may be acceptable for knowledgeable investors, but they are too high for the public sector.

No recourse for any fraud/theft of Bitcoin

Security is one of the most important elements of block-chain technology. It uses cutting-edge cryptography which is unbreakable if implemented properly. There is no central database of transactions that can be hacked. Instead, all the ledger details are copied to transaction participants across the globe. This distribution makes the transaction data unhackable. So what could go wrong?

The security design is laudable but there are still weak points. The Mt. Gox theft of 850,000 bitcoins (more than $500 million) is the most famous case. Mt. Gox was not a hack of a transaction but instead a hack of the Bitcoins at rest in the Mt. Gox “digital wallet”. Also, as is always the case in information technology, the most significant weak point is going to be the humans. Human users are subject to “phishing” and other social engineering attacks. The problem is, once a fraudulent transaction occurs there is a perfect record of it — but no recourse.

Once again, this risk profile is too high for a public sector organization to consider.

Recommendations

The technology is new and exciting. But, the risks inherent in transacting in this environment are too high for public sector organizations. Further, widespread Bitcoin use could have a significant negative impact on government revenues. For these reasons there are two overriding recommendations for your consideration:

- Do not go out of your way to accept or promote Bitcoin

- If you happen to be party to a transaction from which you get Bitcoin, convert it to Cdn$ as soon as possible

But do watch this emerging technology area. In particular, block-chain technology looks poised to enter the mainstream in the not too distant future.

Source: Crypto New Media