The Dow Jones Industrial Average (DJIA) briefly hit a record high in yesterday’s trading session. But the optimism could be short-lived with all signs pointing to a disastrous second-quarter earnings season.

77 percent of companies that have released Q2 guidance have warned they’ll underperform Wall Street estimates. It’s the most negative earnings backdrop in 13 years.

Traders are distracted by Trump’s truce with China and the tantalizing promise of interest rate cuts. But they’re ignoring the wildly negative data coming out of corporate America itself.

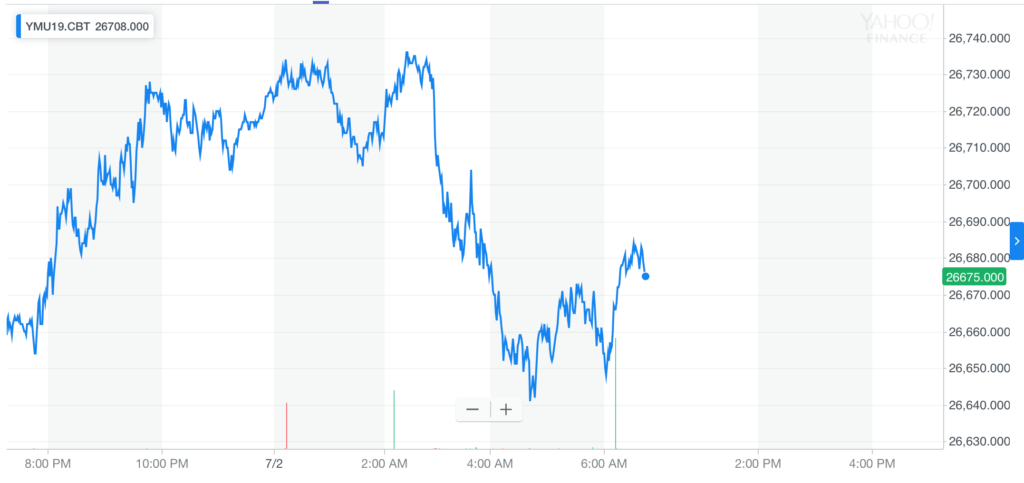

Dow futures flat on Tuesday after record highs

Yesterday’s relief rally, which pushed the US stock market to record highs, is already fading. At 7.03 am EST Tuesday, Dow futures slumped 24 points (0.09 percent) pointing to a flat open at the bell.

S&P 500 futures are also flat after the flagship index carved out new highs in yesterday’s trading session. Nasdaq Composite futures were sightly lower at 7,779 in pre-market trading.

Brace for the worst corporate earnings since 2006

While all eyes are on trade negotiations, Wall Street is about to get a seismic shock. Company guidance going into Q2 earnings season this July is at 13 year lows. 113 US companies have so far issued guidance and more than three-quarters are expecting numbers to come in below Wall Street estimates.

“If you’re worried about earnings, you should be taking some chips off the table… We’ve had a real nice rally this year. I wouldn’t be surprised if we had a pullback.” – Mitchell Goldberg, ClientFirst Strategy.

Earnings per share could fall 1 percent year-on-year across the board, but the pain will be most severe in the information technology sector. Apple and semiconductors could see earnings fall by 10 percent. Multinationals, which bring in a large portion of earnings from overseas, will also be hit hard.

Dow is “priced to perfection” and the storm is coming

Mitchell Goldberg, president of ClientFirst Strategy, thinks traders have overcooked the S&P 500 and the Dow. He believes the stock market is inflated on trade deal and monetary easing hopes. Any negative news could bring the Dow crashing back to reality.

“Stocks are priced for perfection. You haven’t seen too much suffering yet, but it’s kind of incipient. It’s creeping into the numbers little by little.”

If corporate earnings are as poor as expected when the numbers trickle in this July, we could see a sharp correction.

Trade war hits Q2 earnings

Much of the negative Q2 guidance we’ve seen so far pins the blame on trade war fears. As this chart from The Economist shows, corporate executives are increasingly citing “trade,” “trade war” and “tariffs” in their investors calls.

“Executives of publicly traded companies are discussing Mr Trump’s tariffs in about 15% of their calls, up from 5% a year ago. Mentions of the president’s trade war, which began to appear early last year, have also risen.”

The Trump narrative maintains that tariffs on China bring money into American vaults. But evidence shows that many US companies are absorbing the tariff costs themselves, putting huge pressure on their bottom line.

Click here for a real-time Dow Jones Industrial Average (DJIA) price chart.

Source: Crypto New Media