Ten years from now, the story of Satoshi Nakamoto – the anonymous creator of Bitcoin – may very well become as unknown as the story of Tim Berners Lee, the creator of the world wide web. Satoshi, not only created the world’s first cryptocurrency, but a technology revolution that is changing the world.

But, if you were to ask the average person today about how Bitcoin and blockchain are changing the world, their response would likely be that it is actually destroying it. Why? Because Satoshi’s invention has spawned the birth of thousands of cryptocurrencies and blockchain projects that place unsustainable demands on the world’s energy resources.

The problem

As of June 2018, Bitcoin mining uses 71 terawatt hours (TWh) per year, equivalent to almost 10% of China’s annual energy usage. If Bitcoin was a country, it would now be the world’s 41st largest energy consumer, just behind Chile. This energy grows at an astounding rate increasing many multiples in the last year. Many have sought to ameliorate this uptake in energy with clever solutions, such as:

| Efficient Miners | Low | Short |

| PoS | Medium | Medium |

| Cheap and Renewable Energy Usage | Low | Short |

| New Code like Lightning Network | Low | Short |

| Future Blockchain Applications | High | Long |

Possible solution #1: More efficient miners

As the blockchain community grows, more companies are becoming involved in making the hardware that supports the computing necessary for blockchain processing. As more competition arises, new chips will come onto the market with a significant gain in efficiency.

Unfortunately, the potential of this solution to save energy is low, because cryptocurrency networks sense the level of computing power and accommodates accordingly.

Possible solution #2: Proof of stake (PoS)

Many brilliant minds are working on alternatives to the current proof-of-work based consensus algorithm. The hope is to reduce the power consumption of blockchain networks by creating more efficient methods of maintaining ledger integrity. Some of these ideas are pretty far along (Casper by Ethereum, for example), but they haven’t been released yet or achieved widespread adoption – so this still seems a ways away.

The impact of PoS-based architectures may also be dampened because most implementations of PoS seem to increase the authority or “stake” of some of the nodes, which can look very similar to centralization. In addition, for PoS to have a meaningful impact, it has to be adopted by all networks, which can also hinder its long-term impact.

Possible solution #3: Cheap and renewable energy usage

Placing mining close to cheap and renewable energy is another approach to the proposed problem. Consuming renewable energy to perform blockchain computation is certainly better than using dirty power, but it has no real impact on reducing the overall energy use of the blockchain networks. In fact, it can have a detrimental impact because it may actually consume green energy that would otherwise be used by the grid, ultimately, forcing the grid to purchase more dirty power.

Possible solution #4: New code like Lightning Network

Using a new code like the lightning network could reduce transaction fees, but it doesn’t remove the overall energy use of the network. In fact, layer two solutions consume more power since they add a layer of processing on top of the overall network itself.

For Bitcoin implementing the lightning network, for example, Bitcoin blocks will continue to operate at maximum capacity due to their low throughput limit (every 10 minutes) and as a result, all layer two solutions must eventually submit a ‘meta-transaction’ to the original chain – adding processing costs.

Possible solution #5: New Blockchain Applications

Blockchain applications (also known as Dapps) will eventually have a large impact on reducing energy use since they will drive efficiencies in many of the characteristics mentioned above, as well as the development of new specialized networks which will save energy. The development of this part of the ecosystem is still in its early stages, so it will take time for this to drive significant increases in efficiency. In fact, you could argue that the fundamental efficiencies in the network need to be driven first in order to foster the growth of new widespread blockchain applications. Hence, its the chicken and egg problem.

The Malthusian Trap

As outlined above, none of these solutions present an immediate remedy to the demand that cryptocurrency has placed on the world’s total energy supply. Given the current trend, it would be easy to surmise that energy consumed by the blockchain will soon rival that of the rest of the normal economy. However, to draw such a conclusion would be to fall into the same mistake Thomas Malthus committed almost two hundred years ago.

Malthus compared the English population’s growth rates (at the time, exponential) against the country’s ability to produce food (linear) and despaired, identifying the so-called Malthusian Trap, which states that a constantly growing number of mouths prevent any country from ever growing rich, or even beyond subsistence.

Malthus extrapolated current trends and concluded that no country could grow rich (his own country was in the midst of the world’s first industrial revolution.) To use the same exponential versus linear comparison on blockchain would be to repeat his miscalculation. The revolution was not linear.

Metcalf’s Law In Motion

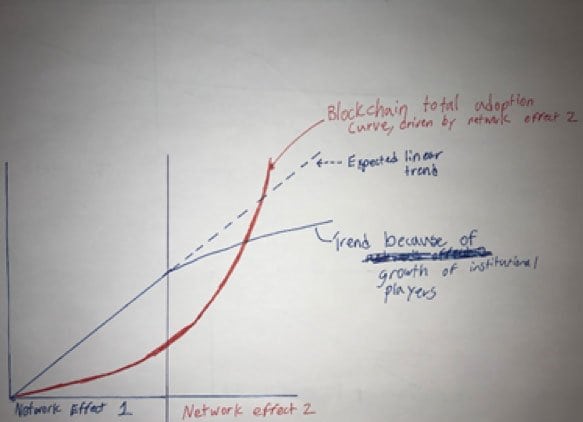

One of many brilliant ideas developed by Satoshi Nakamoto includes using the principle of network effects to secure bitcoin and grow the value of the network through the process of mining. Miners secure the network and process transactions in exchange for cryptocurrencies. Their incentive is to make that cryptocurrency as valuable as possible by increasing the value of the network. As the value of the network grows, more miners will join the network and the cycle repeats again. The power of this network effect in action is one of the greatest events of our time. It has taken cryptocurrencies from an interesting novelty to a worldwide phenomenon. It is also the driver behind this tremendous uptake in energy.

Returning to the lessons of Malthus, however, he reminds us that rates of change should be understood with a real economic framework. In this case, we can view cryptocurrency mining as an arms race. Miners initially began generating bitcoin using their CPUs. Later, they transitioned to GPU computation, on to FPGAs, and finally to ASIC-based mining. Each of these transitions represented a step-function in computing power available to miners. Likewise, miners have become large, global institutions seeking cheap power across the globe in order to achieve efficiencies of scale. As these institutions scale, they have raised and will continue to substantially raise the difficulty of mining across their respective networks, lowering incentives for new players to join (unless they can do so in a big way) and slowing the overall network’s growth in computing power.

From One Network Effect to Another

Satoshi’s economic effect has incubated fledgling cryptocurrencies into real and powerful networks. Along with it, mining has transitioned from hobbyists to institutional players. This is an important metamorphosis and represents a new phase in the blockchain revolution.

There is a second network effect only now beginning to bloom. As large institutions grow into their future states, their incentive will transition from seeking to grow computing power (and suck down energy) to finding new and exciting ways to bring additional services onto the blockchain further increasing the value proposition of their own existence. Glimpses of this second revolution are already being seen and represent a much more significant change in the way we will work and live. The revolution will not be linear.

About

John Belizaire is the CEO of Soluna. Soluna was founded in 2018 with the mission to empower the crypto-economy with clean, low-cost renewable energy. John is an accomplished enterprise software entrepreneur with a track record of new venture development and management success. Prior Soluna, he co-founding FirstBest, he was senior director of business development and strategic planning for BEA’s Ecommerce Applications Division, where he grew annual revenue to over $150 million. Before BEA, John co-founded The Theory Center, a leader in Java-based component software for enterprise applications. As CEO, he grew the company from inception to $10 million in revenue. BEA Systems acquired the company in 1999 for over $160 million.

Source: Crypto New Media