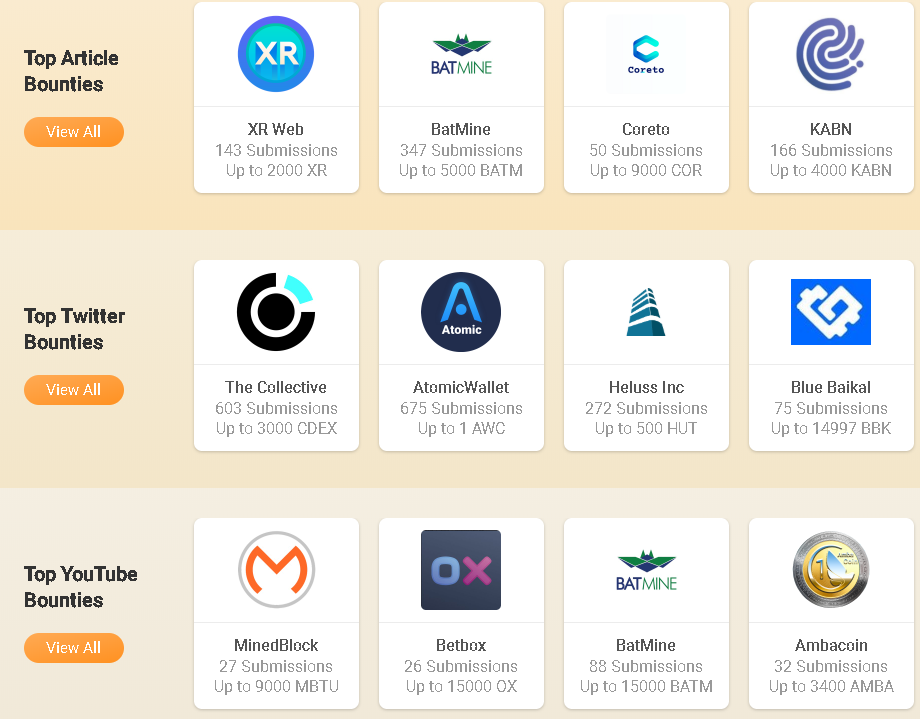

A short example of which projects need help with content creation.

(Source: Bounty0x)

Untamed Crypto Could Be the Wonder Drug for Open Source Development

Many in the crypto industry, whether it be financeers or computer science majors, have yet to crack the code of blockchain’s killer app. Will it be tokenized real estate, dismantling large Internet companies, or something in between?

At this year’s WeAreDevelopers conference in Berlin, Germany, one of the major themes was how to encourage open source development via blockchain technology. And not just distributed ledgers, but tokens. Adding a monetary incentive to what was once a “free” ecosystem could be the real use case for Satoshi Nakamoto’s creation.

Building Open Architecture

Projects that allow entire communities to contribute, revise, and discuss its trajectory tend to be the most successful. This is true up until they run up against financial capture or developers pack it in pursuit of more profitable ventures. Thus, while open source development typically generates the most secure code, the way incentives are aligned also make it the most unsustainable.

Finding a resolution to this issue would have huge implications for the software development industry, not just in crypto.

Platforms in the blockchain space are taking this problem head-on. Bounty programs from Bounty0x, BountyOne, and HackerOne, for instance, are all offering rewards for anyone with an Internet connection. In the case of HackerOne, they offer bounties to developers who point out flaws in code. On Bounty0x the tasks include the non-technical and have even allowed several contributors to make a living on resolving these bounties.

Before attempting to topple the Internet companies of Web 2.0 or outrunning the banks, the blockchain community may have, in many ways, misinterpreted the power of tokenization.

Of course, creating money out of thin air has run into serious regulatory issues, but when used as a mechanism for monetizing open source projects, the results appear promising. This is already a significant difference from the Googles and Facebooks of the world who have a track record of buying out open source communities. When Microsoft bought out GitHub in June 2018, many in the Bitcoin community quickly began looking for alternatives.

After the Github acquisition by Microsoft, do you think the Bitcoin repo should move to Gitlab? (open-source projects like Gnome, Gimp have migrated)

— Wilson (@cryptowilson) June 4, 2018

In a presentation on June 6, 2019, Dimitri de Jonghe, the head of research and co-founder of Ocean Protocol, explained how we are dominated by “privately owned, publicly-used infrastructure.” On top of that, they behave in almost the exact opposite way of open source projects; many of these companies have been built around a business model that incentivizes the siloing of data. Such hoarding of information creates incredibly lucrative honey pots for anyone who can gain access. As a result, the list of data breaches grows longer each day.

Bitcoin and blockchain technology, however, does offer an alternative according to de Jonghe, but it is very one dimensional.

de Jonghe said:

“Basically, it’s a network that incentivizes users to secure it by offering them bitcoin in return,”

Adding:

“As soon as you begin building an alternative business model on top of that, one in which you’re transmitting data rather than just monetary value, you run into problems.”

Although limited, the Bitcoin network has proven that blockchains are effective at getting people to do stuff. What that stuff is exactly is only limited by the imagination.

Mini Economies of Scale

Tokeneconomics, cryptoeconomics, and token engineering is the emerging field of balancing incentives to promote specific outcomes using cryptocurrencies. For Bitcoin, this is how miners are nudged to secure the network, but other blockchain projects are exploring alternative models.

The experimentation is in full effect too if one considers the number of altcoins that have emerged since 2009. As outlined above, folks will do a lot (or even just a little) for a small bag of any hobby coin. Adding new layers to this, startups like Aragon are proving that large-scale governance schemes could replace entire firms.

Tokens are merely the first step. Throw in a smart contract, and you can get a bit more complex. Stack those smart contracts, make a Decentralized Autonomous Organization (DAO), and, voila, end of The Organization Man and the rise of an entirely new digital business model.

This is the direction that Ocean Protocol and others have gone since the rise of Bitcoin. In a crash course of how he entered the space, de Jonghe revealed how his early projects were technologically limited, but after six years of tinkering, much has changed.

Here’s a tech summary of some of the core of @oceanprotocol.

Service Execution Agreements (SEAs) glueing the network togetherProbably spent too much time of finding a suitable gif in the end…

Happy to get some feedback/comments/upside frowns https://t.co/YVzFOXRdpA— WebDimi3 (@DimitriDeJonghe) November 30, 2018

The investigation of how these mini digital economies operate is also attracting myriad bright minds.

Angela Kreitenweis, a founder of Token Engineering Global, outlined a similar future in which a realignment of incentives could “make protecting the planet more affordable than destroying it.” The current configuration, whether it be in pursuit of environmentalism, open source code development or data supply chains, needs only a slight adjustment for it to begin doing social good. More to the point, tokens created from cryptographic networks could play a huge role in this new configuration.

A side effect of all this tinkering and experimentation will be the swell of hobby coins. Some will work, others won’t, and still, others may find themselves paying huge fines for breaking securities laws. Despite this, it’s only normal for such a nascent space to carry along such excess baggage.

The work of many projects, when opened up token by token, show real innovation for solving many features of our digital lives.

Like BTCMANAGER? Send us a tip!

Our Bitcoin Address: 3AbQrAyRsdM5NX5BQh8qWYePEpGjCYLCy4

Source: BTCMANAGER