This Bull Market Is Just Getting Started

Bitcoin (BTC-USD) has just gone through one of its most tumultuous bear markets in history. Bitcoin prices tumbled by as much as 85%, and many altcoins crashed by 95-99%. The cryptocurrency complex experienced a price collapse of nearly 90%, dropping from over $800 billion at its peak to just $100 billion when the bottom hit.

Bitcoin 2-year logarithmic chart

Source: Bitcoincharts.com

However, since the late 2018 bottom, prices of Bitcoin and cryptocurrencies in general have moved substantially higher, strongly suggesting that a new bull market began last December.

Cryptocurrency Complex 2-year logarithmic chart

In fact, given the recent price action and supportive constructive fundamental elements surrounding cryptocurrencies, Bitcoin could achieve a price of $10,000 by the end of this year.

Performance Since 2018 Bottom

Bitcoin going to $10,000?

Since Bitcoin is at around $5,250, it would need to participate by about 90% from today’s price to achieve my price target of $10K

Bitcoin’s 1-year chart looks extremely bullish. We see that capitulation took place last November and brought prices to abnormally low levels by mid-December. This appeared to be a period of indiscriminate panic selling, a washout.

Source: BitcoinCharts.com

The two-year chart also appears extremely constructive as it indicates Bitcoin is attempting to enter a new bull market. We are seeing positive buy side volume pick up in recent months, suggesting renewed buy interest.

The longer-term image paints another constructive picture, as we’ve seen Bitcoin go through several nearly identical price cycles in the past. Each consecutive wave produced much higher prices.

Bitcoin’s next major support is $6,000 – 6,500, then around $8, but the ultimate test comes at $10K, which Bitcoin should breakthrough on improved technical and sentiment based momentum.

Bitcoin bottomed, is still in the very early stages of its new bull cycle, and is likely to appreciate considerably over the next 3-5 years. Shorter-term, we may see that $10K – $15K prices within the next 12-18 months, 90%, and 185% gains respectively.

Signs of Stabilization and Improving Market Conditions

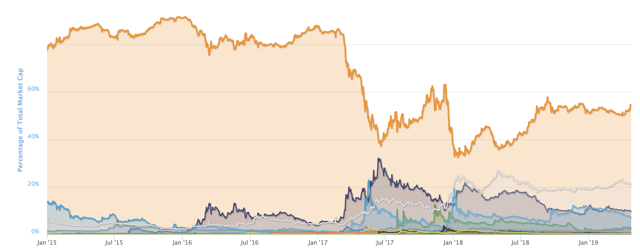

We see that Bitcoin has gained 65%, and the overall cryptocurrency market is up by 70%. Bitcoin dominance has stabilized at 50 – 55% and the entire market is beginning to behave in a much more stable manner.

Bitcoin Dominance

Source: Coinmarketcap.com

At 55% dominance Bitcoin’s value is equivalent to 55% of the entire cryptocurrency market. However, as this cryptocurrency bull markets progresses certain altcoins will likely drastically outperformer Bitcoin.

In fact, we’ve seen this occur already with Litecoin, Bitcoin Cash, Dash, and many others. It is also likely that some high quality transactional coins like Zcash and Dash could be trading higher, as they allow for some of the most efficient, mass scale transactions to occur seamlessly, with near zero cost.

Bitcoin: A Small Drop in a Very Big Bucket

Let’s look at the big picture, Bitcoin is a very tiny drop in a very big financial bucket right now. Its market cap is only $93 billion, while the entire cryptocurrency complex’s is just $170 billion. This is miniscule relative to all the fiat money and gold supply in the world market today.

Bitcoin and cryptocurrencies are competing directly with physical fiat money, as well as with the M2, M3, and investible gold. The primary markets are global medium of exchange, and global store of value. However, Bitcoin and altcoins are also starting to compete with stocks, commodities, and even debt as they are becoming competing trading/investment vehicles.

So, How Big is The Market?

The broad money supply along with investable gold account for about $95 trillion of the world’s assets. Equity marketers are also huge, representing about $73 trillion in global value. Global debt is estimated to be a around $215 trillion, and if we look at derivatives, estimates point to over 1 quadrillion in total worldwide derivatives.

We’ll exclude derivatives for now, but incorporating $95 trillion of global store of value and medium of exchange, $73 trillion in stocks, and $215 trillion in debt, provides Bitcoin with a $383 trillion market to continue to expand market share in.

Right now, the cryptocurrency complex in total is worth only $170 billion, compared to a massive $383 trillion in fiat, debt, and stock market competing assets. In fact, $170 billion represents just 0.04%, fewer than half of one tenth of one percent of the market’s immense value. This essentially implies that there is about 99.96% of untapped market share for Bitcoin and other digital assets to go after.

At just 1% market share, the cryptocurrency complex would be worth $3.83 trillion, and if Bitcoin remains roughly 50% dominant its market cap would be around $1.9 trillion, giving it a price target of $90,000.

At 5% of market share, the cryptocurrency complex would be wort around $19.5 trillion, and if Bitcoin holds on to 50% dominance rate, Bitcoin’s market cap could reach nearly $10 trillion, making each Bitcoin worth approximately $450,000.

Even if Bitcoin’s dominance declines to around 20% share of the market, Bitcoin’s market cap would be around $3.9 trillion, making each Bitcoin worth about $186,000.

This is a longer-term trajectory scenario, but as Bitcoin’s network expands, it could materialize within the next 5-10 years.

Bitcoin: The Network Effect

The internet, or Facebook (FB), would they be enormously profitable and successful if only a handful of people used them? How about a million, or 10 million, a hundred? It is when millions and billions of people begin using these networks that they become increasingly powerful and profitable.

The same principle applies to Bitcoin, the more people use the Bitcoin network, the higher its price rises, much like the value of a stock price in a company. Today, it is estimated that nearly 20 million people around the world use, trade, or own Bitcoin.

There is an irrefutable correlation between Bitcoin’s price and the number of blockchain wallets being created throughout its history. The trend is clear, as Bitcoin gains popularity, more and more users continue to join the Bitcoin blockchain network.

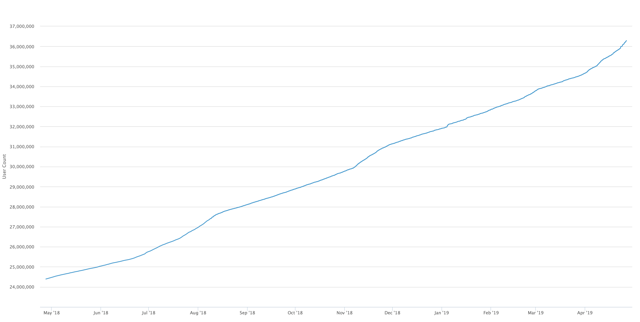

Blockchain Account Growth

Source: Blockchain.com

Blockchain account growth has gone 50% higher YoY, and appears to be getting ready to reaccelerate. It seems likely that price will begin to pick up with increased demand going forward. We also know that blockchain account growth is highly correlated with Bitcoin’s appreciation.

We can essentially pinpoint that Bitcoin’s price has peaked at roughly 1% of its blockchain users, several times now. Bitcoin’s price to blockchain accounts at peaks was $7 at 1,000 accounts, $200 at 200,000 accounts, $1,200 at 1 million accounts, and $19,500 at 20 million accounts.

So, how much will Bitcoin be worth if there are 100 million blockchain accounts, or 1 billion blockchain accounts?

Simply going by past price appreciation, Bitcoin could be worth $100K if around 100 million people join the Bitcoin network, and it could be worth $1 million if a billion people or more users are ever on the Bitcoin blockchain network.

Bottom Line: Buy Bitcoin Now, Your Future Self Should Thank You for it

The vast majority of the population do not own, trade, or use Bitcoin right now. This leaves Bitcoin with incredible growth momentum, and a massive, 99.5% untapped market.

Meanwhile, the global fiat based market represents roughly $373 trillion in total value. The entire cryptocurrency complex is worth but a fraction, $175 billion, 0.04%, relative to the fiat’s 99.96% market share.

Bitcoin and the cryptocurrency complex in general can continue to capture market share in these massive global medium of exchange, store of value, and trading/investing vehicle markets.

Technical factors and other dynamics also point to much higher prices for Bitcoin and the cryptocurrency complex.

Buy Bitcoin now, and your future self will thank you for it.

12 Month Price Target: $10K

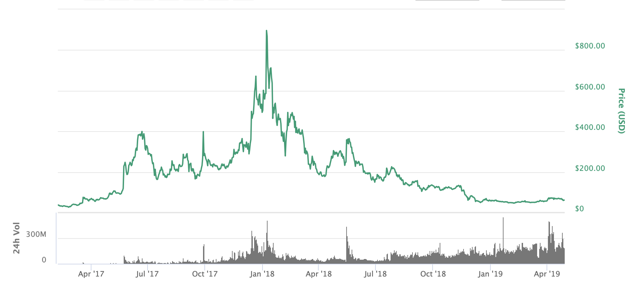

Zcash: Likely Very Undervalued

Zcash is a coin much like Bitcoin that specializes in privacy protection, something Bitcoin does not. The currency and its blockchain are also considered to be remarkably safe and reliable. Zcash is currently at $60, 93% cheaper from its $850 price it at the start of 2018.

Zcash can be looked at like a startup company that offers an incredibly efficient payment system with enormous long-term potential. Yet, it is currently valued at only $385 million.

Zcash Chart

Zcash Log Chart

Zcash Log Chart Zcash was valued at around $5.5 billion at the time when it topped, so it could be argued that the company’s valuation got ahead of itself. However, now that it is current at $385 million the valuation appears much more reasonable and compelling.

Zcash was valued at around $5.5 billion at the time when it topped, so it could be argued that the company’s valuation got ahead of itself. However, now that it is current at $385 million the valuation appears much more reasonable and compelling.

Safety First: some common risks to be aware of with crypto assets

Detrimental Government Regulation

Possibly, the No. 1 long-term threat Bitcoin faces is detrimental government regulation or an all-out Bitcoin ban. If major Bitcoin-friendly governments like the U.S., E.U., Japan, South Korea and others follow the footsteps of China and essentially make Bitcoin use and trading illegal, it could have catastrophic consequences for Bitcoin’s price.

Continued Functionality Issues

Another risk factor is the concern that Bitcoin may never become a widely-used transactional currency due to its issues with speed and scale. Yes, the Lightning Network promises to solve many of the issues associated with speed, cost and scale, but there’s no guarantee that the LN will become widely adopted, even over time.

Therefore, there’s the risk that newer and more efficient digital currencies like Litecoin, Bitcoin Cash and others may make Bitcoin somewhat obsolete as an actual medium of exchange for the masses.

Continued Security Breaches and Fraudulent Activity

Continued security breaches in the Bitcoin world concerning exchanges and individual wallets is a constant concern. If significant breaches continue, investors and users may start to lose confidence in the system and demand could decrease as well.

Likewise, there are fraud cases. In an industry that’s still loosely regulated, substantial fraudulent activity is a persistent risk factor. Just like with security breaches, when people get ripped off, it reflects poorly on the entire industry and demand along with prices can suffer.

Bitcoin is Not for Everyone

The bottom line is that Bitcoin is not for everyone. I view it as an investment for people with a relatively high risk tolerance, and even then, maybe only 5%-20% of a portfolio’s holdings should be allocated to digital assets.

Bitcoin is still a relatively new phenomenon, and no one truly knows exactly how it’s going to play out over the long term.

Want to know more? If you would like full articles that include technical analysis, trade triggers, portfolio insight, option strategies, and much more, consider joining Albright Investment Group!

- Subscribe now and obtain the best of both worlds, deep value insight, coupled with top-performing growth strategies.

- Receive access to our top-performing portfolio that outpaced the S&P 500 by 19% in 2018.

- Take advantage of this limited time 2-week free trial offer now and receive 20% off your introductory subscription pricing. Click here to find out more!

Disclosure: I am/we are long BTC-USD, BCH-USD, LTC-USD, DASH-USD, ZEC-USD. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article expresses solely my opinions, is produced for informational purposes only and is not a recommendation to buy or sell any securities. Investing comes with risk to loss of principal. Please consider consulting a professional before putting any capital at risk.

Source: “bitcoin” – Google News